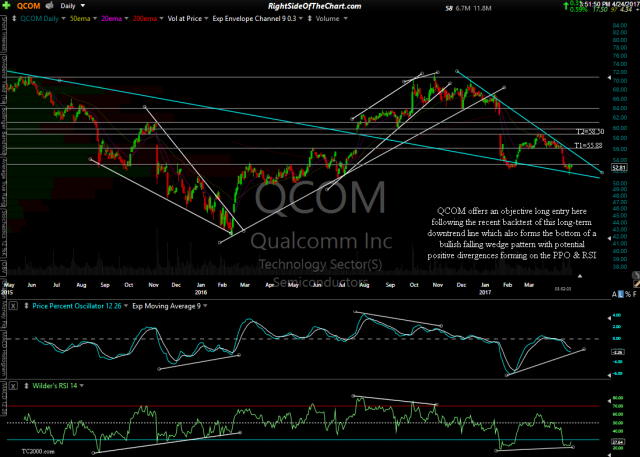

QCOM (Qualcomm Inc.) offers an objective long entry here following the recent backtest of this long-term downtrend line which also forms the bottom of a bullish falling wedge pattern with potential positive divergences forming on the PPO & RSI. The second chart is a 4-year, 2-day period chart which shows the entire downtrend line which QCOM hammered off of on Thursday’s backtest: a 2.8 year trendline defined by numerous reactions.

- QCOM daily April 24th

- QCOM 2-day period April 24th

I am adding QCOM as an Active Long Swing Trade here around current levels (current price now 52.81) for a couple of reasons. First & foremost, this leading semiconductor stock has bucked the trend since late 2016, plunging over 28% while the semiconductor sector made a nearly straight ascent to all-time highs. While such start underperformance is and was a red flag for Qualcomm, it appears whatever fundamental issues that the company has or will experience has most likely already been fully priced in, at least for the foreseeable future.

QCOM is not only coming off extreme oversold readings on the daily RSI but the stock is also forming potentially powerful bullish (positive) divergences on the PPO, MACD & RSI. In addition to hammering off that long-term downtrend last week, the stock is also hovering around the key 53ish level, which has acted as both support & resistance on numerous occasions going back a decade or more.

The other reason for adding QCOM as an Active Long Swing trade as well a going long the stock personally today is to provide a partial hedge to my short position on the semiconductor sector as well as the official SOXS / SOXX Active Short Trade. Just to be clear, I remain bearish & still expect a significant correction in the semiconductor sector in the coming months. Should that expectation pan out, then QCOM could quite possibly get dragged down with the sector but just as the stock plunged over 28% while the semiconductor sector rallied by nearly the same percentage, the stock could also advance during a broad-based correction in the semis. Either way, I believe that a decent case for a rally in QCOM from or near current levels can be made.

The price targets are T1 at 55.88 & T2 at 58.50 although any traders looking to book quick profits could target the downtrend line which forms the top of the falling wedge pattern. The suggested stop will be set on a move slightly below Thursday’s of 51.40 (to allow for one final stop-clearing raid), with any move below 51.32 as the official stop. The suggested beta-adjustment for this trade will be 0.90 although one might also take into consideration their overall exposure, if any, to the semiconductor sector in determining their position size whether taking QCOM as a pure-play long trade on the semis or a hedge to an existing or planned short trade on the sector.