Following the recent breakout above the basing pattern (white box). MU (Micron Technologies Inc.) has been consolidating in what appears to be a bullish pennant continuation pattern. A long entry will be triggered on any print of 13.16, assuming that occurs by the end of this week (if not, I will update the trade & decide whether to pull the setup or modify the entry). The MU bullish pennant can be seen clearly on this 60-minute time frame. I have set the buy trigger at any print of 13.16 which is slightly above the pennant & today’s previous high.

- MU daily June 7th

- MU 60-minute June 7th

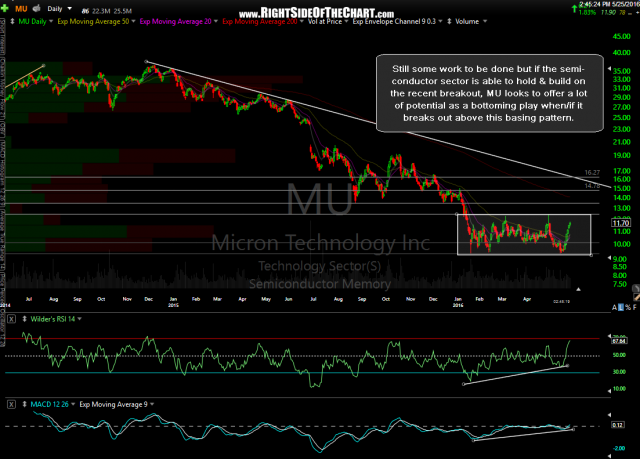

The suggested (and official) stop for those targeting T2, which is my preferred target), is any move below 12.62. Those only targeting T1 (for a quick trade) should use tighter stops while longer-term traders holding out for the final target, T3 which is the yellow downtrend line, or a possible long-term trade to the 21 area, could use a more liberal stop. MU was highlighted as an unofficial trade setup about two weeks ago in the trading room & again last Tuesday on the breakout above the pattern (charts below).

- MU daily May 25th

- MU daily May 31st