as we head into the final hour of trading, i just wanted to share my market thoughts. as i can not give specific investment or trading advice, i can, and do, share my thoughts on the market as well as how i am personally trading. as always, my opinion will be right at times, wrong at others so always DYODD and trade according to your own market beliefs, trading style and risk tolerance.

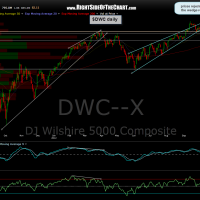

with that being said, i’d like to highlight that so far, the market is playing out exactly as i have been predicting for weeks and even months now. in particular, i have been making that case that the recent, and much celebrated “bullish breakout to new highs” by the stock market would more than likely prove to be bull traps. we are still waiting for the broad indexes ($SPX & $DWC) to confirm with a solid move back below their recent new-highs breakout levels (~1425 on the $SPX & ~14,670 on the wilshire), today’s price action only helps increase the already strong odds that it will happen. therefore, not only do i not plan to cover any short positions today (other than some ITM oct puts that i had to close), i added to my short exposure today.

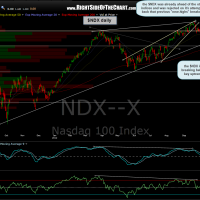

the fact that we are having a down day might be viewed by some as a random event, as unusually large selling days are common from time to time, even during an uptrend. however, the fact that the major indices have put in such large, impulsive candlesticks immediately following the re-test of those key resistance levels that i posted yesterday morning (below) adds considerable validity to those patterns. here are those charts from yesterday (made before the open) followed by today’s updated charts showing how prices were rejected sharply off those levels and are now threatening to break back below those prior new-highs breakout levels. barring any type of meltdown into the close, we will most likely have to wait until next week to see if the markets can hold these key support levels and bounce, or if we break back down below those levels, obvious a very bearish technical event. even if we close slightly below today, or bounce sharply into the close, i would not read too much into that action. remember, today is OpEx (options expiration) and late-day price swings are common as positions are squared off into the close.