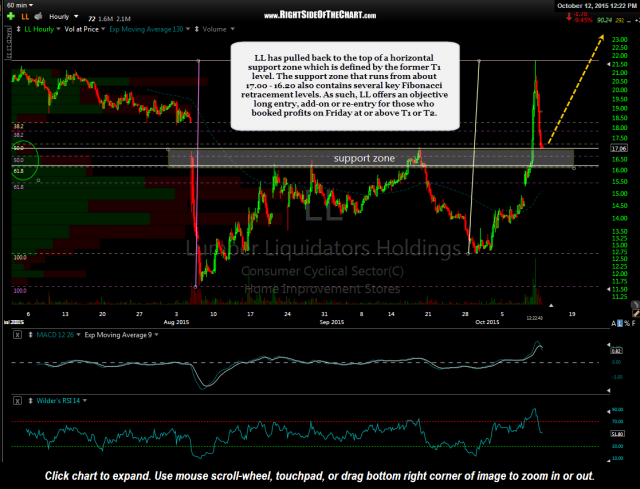

LL (Lumber Liquidators Holdings) has pulled back to the top of a horizontal support zone which is defined by the former T1 level. The support zone that runs from about 17.o0 – 16.20 also contains several key Fibonacci retracement levels. As such, LL offers an objective long entry, add-on or re-entry for those who booked profits on Friday at or above T1 or T2.

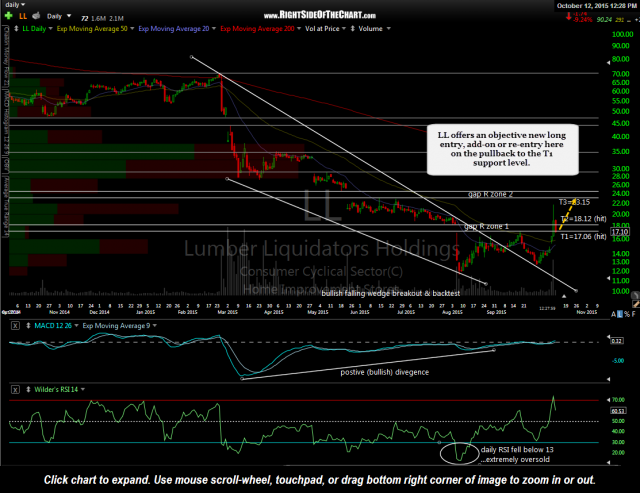

T3 (23.15) remains the next & current final target with the possibility of additional targets to be added to the Long-term Trade while the Active Long Trade (i.e.- swing trade) will be closed if/when LL hits 23.15. Suggested stops for an new position taken here would for a long-term trader/investor would be on a daily close below 14.90 while swing traders might consider a stop on any intraday move below 14.90. Updated 60-minute & daily charts below.

- LL daily October 12th

- LL 60 minute Oct 12th