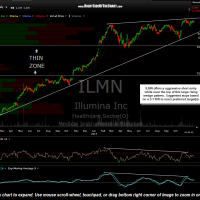

ILMN (Illumina Inc) offers an aggressive short entry while near the top of this large rising wedge pattern with a more conservative/conventional entry or add-on to come on a break below the bottom of the wedge. Suggested stops based on a 3:1 R/R to one’s preferred target(s). Barring a large gap down, ILMN will be added as an Active Long Trade at the open tomorrow.

The large rising wedge pattern on the daily (first) chart below can also been viewed on the weekly (second) chart along with the percentage drops that followed all other similar weekly divergent tops over the last decade (39-68% corrections). Two of those three previous corrections bear markets in ILMN occurred while the US broad markets were solidly entrenched in bull markets (2006 & 2011), highlighting the fact that money can be made shorting the right stocks at the right time in a bull market. My plan for this trade is to take a fractional position here near the top of the pattern, adding to the position if & when prices break below the bottom of the wedge although I may also decide to cover my position on the initial tag of the uptrend line (then shorting a full position on a break below the pattern).

- ILMN daily Dec 2nd

- ILMN weekly Dec 2nd

Of course the markets are dynamic and as such, so are my trading plans. T2 at 136.10, which is set just above the 134 horizontal, is the current preferred swing target at this time. Should prices ultimately make a solid break below the 127 support level (not drawn on this chart), especially if the broad market were to be in a confirmed downtrend at the time, the chances would be good for a back-fill of the thin zone that runs from 134 down to the 86 level.