On a quick admin note, I had starting reviewing the Active Short Trades last week in order to highlight some of the more attractive existing short trades and removing all stopped out trades or any other active trades that no longer look very compelling at this time. As I’ve had a lot of non-trading related stuff pop up on my plate recently, I’m still working updating that category and hope to have the list updated soon in order to focus on the most attractive existing and new short trade ideas. Although I’ve paired back quite a bit on posting analysis on the broad markets lately (due to the holidays as well as the fact there hasn’t been any compelling developments over the last month or so), it does appear that we may be in the cusp of, if not the early stages of the first decent correction in a while, today’s snap-back rally notwithstanding . With the recent extreme overbought and over-bullish sentiment coupled with numerous & substantial breadth & momentum divergences, the odds of a swift move down to the 3318-3255 area on the $NDX (8-10% drop) and the 1705-1709 area on the $SPX (~8%) is pretty decent at this time, although my focus remains on trading the best individual stock setups, long and short, versus trying to game the broad market via the index tracking vehicles SPY, ES, QQQ, etc… I also remain bullish on the gold & silver mining stocks, select hard & soft commodities, & all of the active Growth & Income Trades which are a sub-set of the Long-Term Trades category. Updates on those long trade ideas to follow soon.

On a quick admin note, I had starting reviewing the Active Short Trades last week in order to highlight some of the more attractive existing short trades and removing all stopped out trades or any other active trades that no longer look very compelling at this time. As I’ve had a lot of non-trading related stuff pop up on my plate recently, I’m still working updating that category and hope to have the list updated soon in order to focus on the most attractive existing and new short trade ideas. Although I’ve paired back quite a bit on posting analysis on the broad markets lately (due to the holidays as well as the fact there hasn’t been any compelling developments over the last month or so), it does appear that we may be in the cusp of, if not the early stages of the first decent correction in a while, today’s snap-back rally notwithstanding . With the recent extreme overbought and over-bullish sentiment coupled with numerous & substantial breadth & momentum divergences, the odds of a swift move down to the 3318-3255 area on the $NDX (8-10% drop) and the 1705-1709 area on the $SPX (~8%) is pretty decent at this time, although my focus remains on trading the best individual stock setups, long and short, versus trying to game the broad market via the index tracking vehicles SPY, ES, QQQ, etc… I also remain bullish on the gold & silver mining stocks, select hard & soft commodities, & all of the active Growth & Income Trades which are a sub-set of the Long-Term Trades category. Updates on those long trade ideas to follow soon.

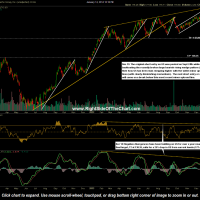

Moving on to the Short Trade Ideas update, GS will remain as both an Active Trade and new Short Setup for now. Although not one of my favorites, I do think that GS has a good shot of moving down to the final target, T2 at 130.35, within a few months of prices breaking below the current ascending price channel (white parallel lines). With the recent bearish crossover on the MACD as well as the RSI rolling off overbought levels, which confirms the divergences that have been building over the last 12 months, GS should remain below the recent Jan 6th high of 181.13 to keep the bearish scenario intact. As such, GS will be considered stopped out on any daily close above that level and may also be removed as a Short Setup. Click here for the live chart of GS