As mentioned the other day, gold stocks (GDX & the $HUI) have recently fallen to their prior 2008 reaction lows, a level (or more accurately, a range vs. the exact lows) which is likely to act as key support. Not only do we have gold stocks trading down to those previous decade+ lows but more importantly, we have potentially bullish developments from both a technical & fundamental perspective.

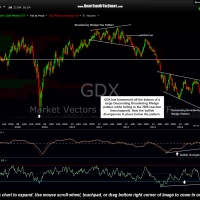

From a technical view, barring some crazy reversal into the close today, GDX will have printed a nice weekly hammer candlestick right off the bottom of a fully mature Descending Broadening Wedge bottoming pattern. The miners (GDX & $HUI) also have strong bullish divergences in place on numerous price & momentum indicators & oscillators, such as the weekly PPO & RSI as shown below.

- GDX weekly Nov 7th

- $HUI weekly Nov 7th

From a fundamental perspective, there are two bullish conditions that stand out to me: 1) Gold prices are about 60% HIGHER today than they were when the gold mining sector was trading at the same levels today as it was back at the lows in 2008. 2) It is also worth noting that energy prices (as measured by USO, the crude oil ETF) are trading about 30% BELOW where they were when the mining sector bottomed back in 2008. Energy costs are one of the largest expenses to the mining sector so with their cost to extract gold from the ground considerably lower than back in 2008 AND the price that they receive for gold much higher today than it was back then, the miners are starting to look very attractive from valuation perspective as well as technically (charting).

Of course, rising gold prices or at the very least, a leveling off in gold prices soon would really help build the case for a lasting bottom in the gold stocks. My primary scenario at this time remains a wash-out move in gold which will be confirmed if/when GLD can make a solid & sustained move back above the 115. Such a move would likely spark a short-covering rally in both gold & the mining stocks as well as attract some new buyers. The dollar remains a big variable in this equation but so far, I have not seen anything in the charts that dampens my view for a likely reversal in the dollar from at or near current levels.