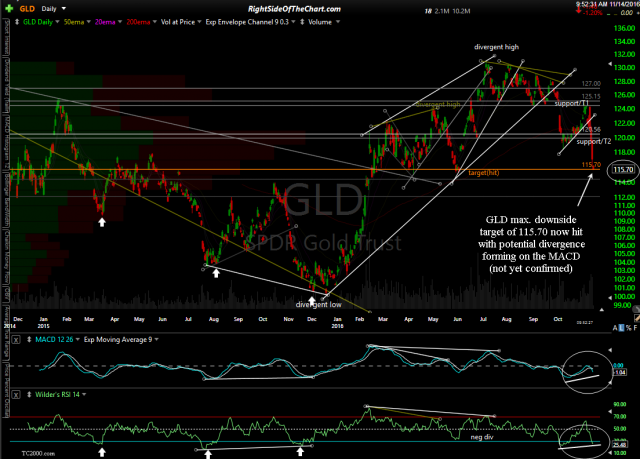

GLD (Gold ETF) has hit my maximum downside target of 115.70 now hit with potential divergence forming on the MACD (not yet confirmed). While I might normally (and still might soon) step in & go long here, there are some things that have me quite concerned with the financial markets right now, including the recent melt-down in both gold & US treasuries, both of which have the potential to cause ripple effects within the financial markets.

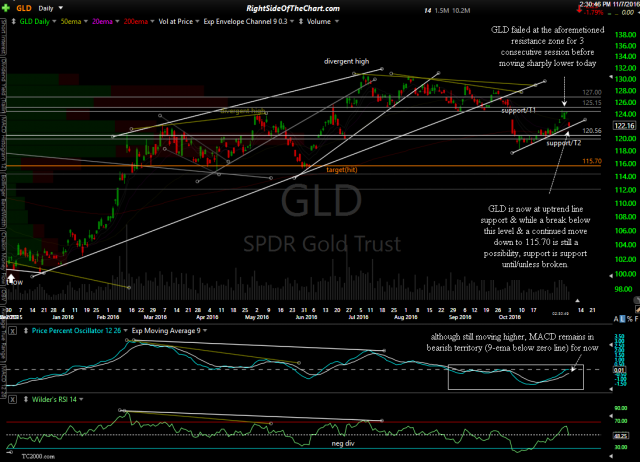

- GLD daily Nov 7th

- GLD daily Nov 14th

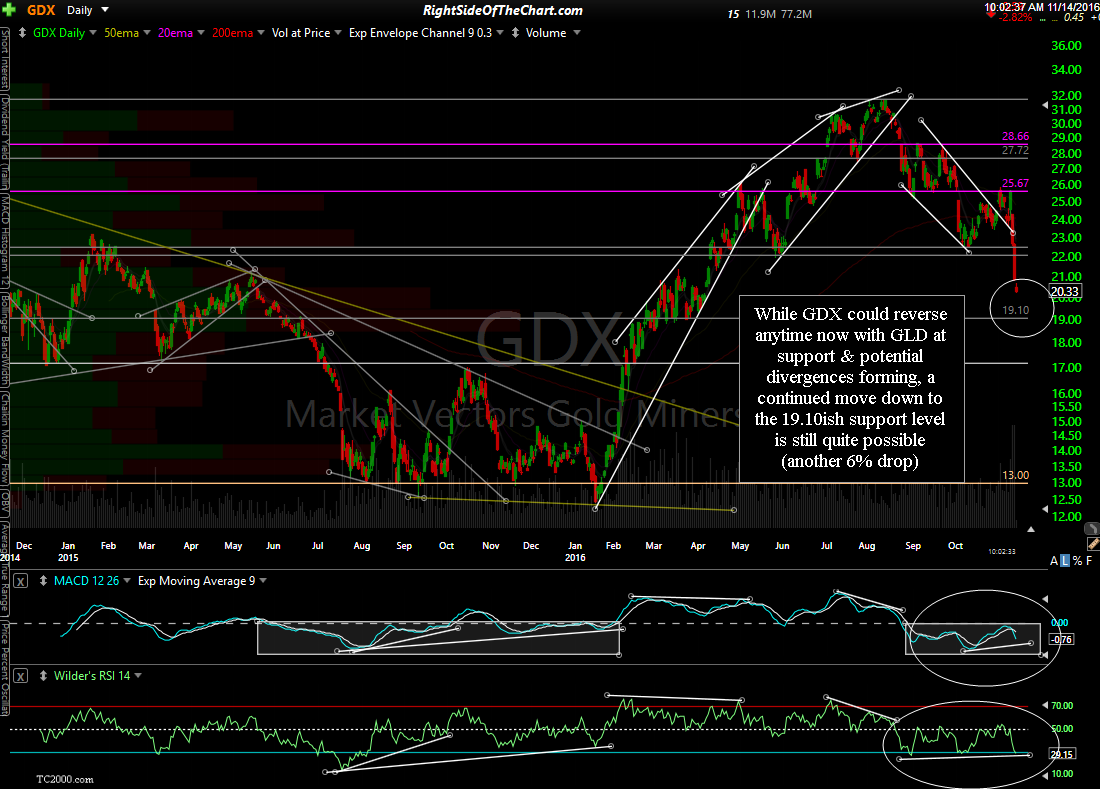

As most of you are aware, I typically prefer to trade the gold mining stocks (GDX and/or individual miners) in lieu of gold or GLD as you simply get more bang for your buck with the miners when you get the directional call on gold correct. However at this point, I’m holding off & would prefer to watch the charts for a bit before engaging the miners. While GDX could reverse anytime now with GLD at support & potential divergences forming, a continued move down to the 19.10ish support level is still quite possible (another 6% drop).

If I had to take one or the other, I would prefer to be long the metal (gold) vs. the miners at this time simply because the downside risk is lower & I could also see the possibility that GLD holds around the 115.70 support area with the miners continuing lower for a bit before any meaningful reversal. Again, I just plan to watch for now & will post any significant developments that I notice in the metals & miners. With that being said, with gold at key support (with additional support levels not too far below) & GDX about 6% above key support, one could certainly start scaling into a position in either gold and/or the precious metal stocks with the appropriate stops below.