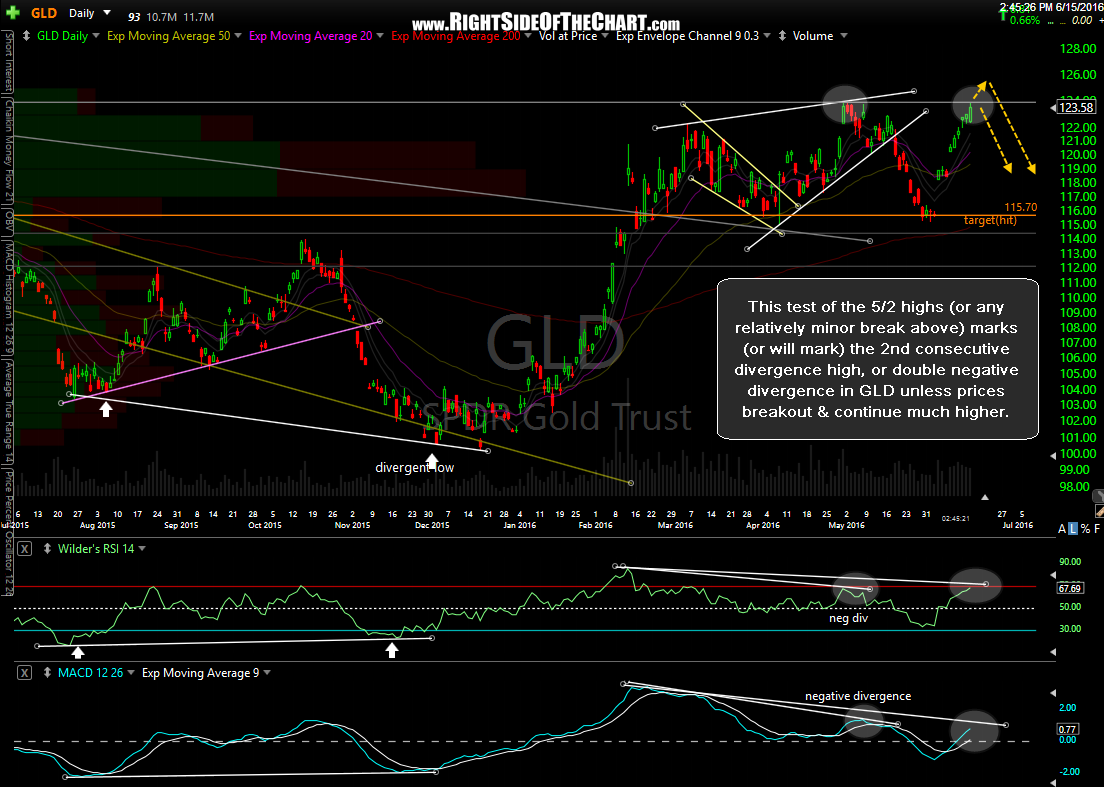

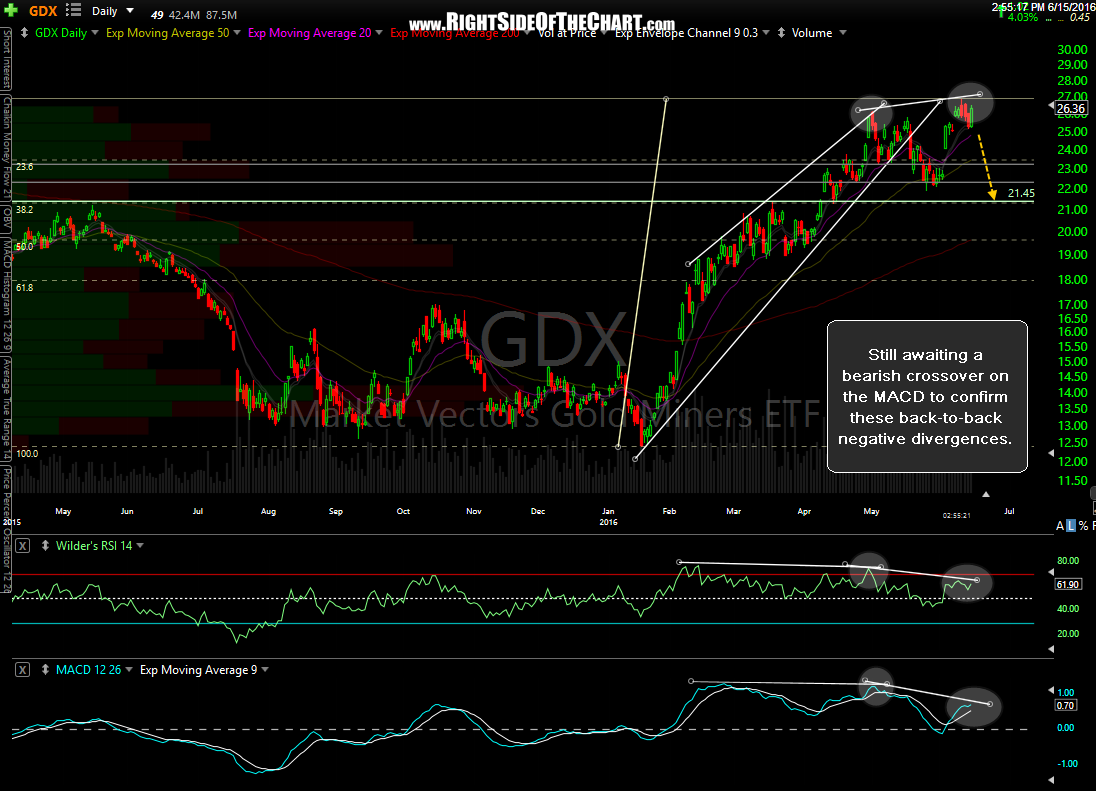

This test of the 5/2 highs (or any relatively minor break above) in GLD (gold ETF) marks (or will mark) the 2nd consecutive divergence high, or double negative divergence in GLD unless prices breakout & continue much higher. I’ll be watching the price action closely in the next few sessions to see if gold can breakout & burn through these divergences by continuing higher (thereby putting in higher highs in the RSI & MACD) or whether GLD prices fail here on the test of the May 2nd highs or on any minor breakout above as that might offer an objective short entry on GLD and/or GDX.

On Watch for Consecutive Divergent Highs In GLD & GDX

Share this! (member restricted content requires registration)

5 Comments