Broad Markets

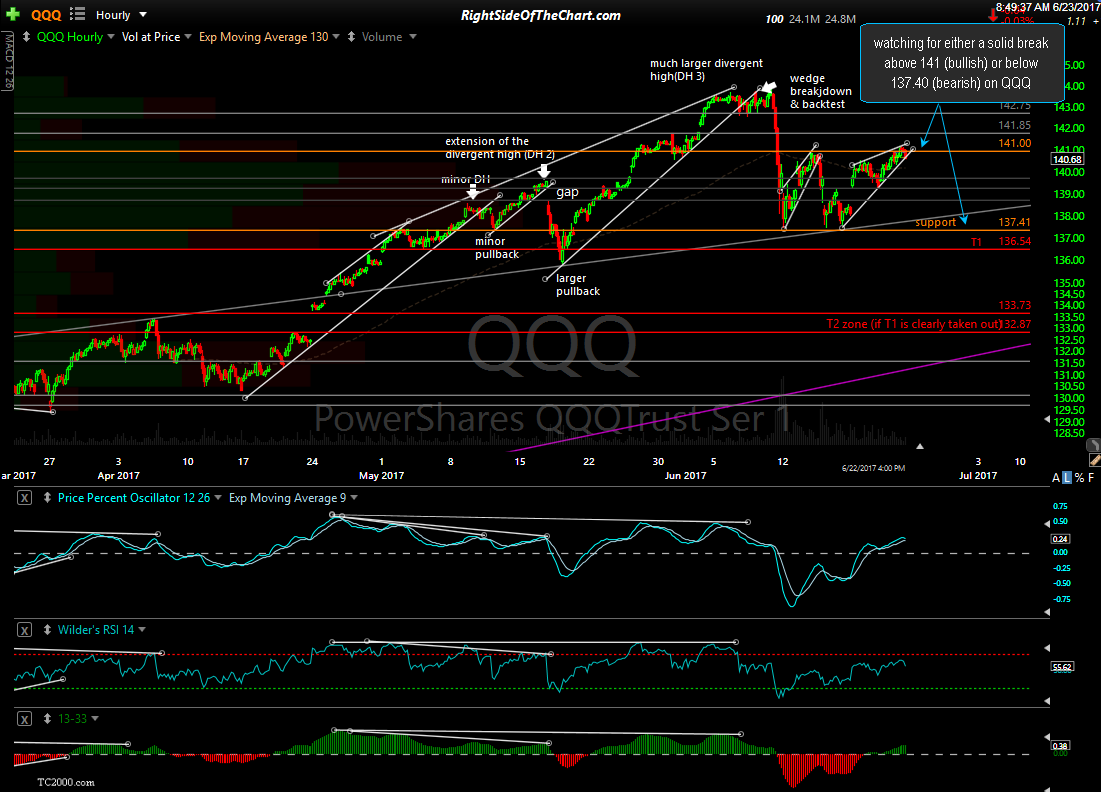

As I’ve already posted extensive analysis on the equity markets as well as various commodities, sectors & precious metals over the past week I figured that I’d keep it simple & share what I’m most focused on with the stock market at this time. At the risk of over-simplifying something that is quite complex with countless variables & other related factors, I’m watching for either a solid break above 141 (bullish) or below 137.40 (bearish) on QQQ (Nasdaq 100 ETF) as per yesterday’s QQQ & FAAMG Stock Analysis video. While a solid & sustained break above or below either of these levels certainly isn’t “do or die” for the markets, they do appear to be significant levels that could likely determine the next tradable trend in the market (bullish or bearish). I’m more concerned with a daily close above or below this levels vs. any intraday pops above or below.

Sectors & Commodities

While the analysis of the broad equity markets is typically part of any swing trader’s or investor’s homework, unless they are exclusively trading the broad market tracking instruments that isn’t where the money is made. As recently stated, the “stock market”, from the most representative large cap index, the S&P 500, down to the most representative small cap index, the Russell 2000, has essentially gone nowhere for month now while trading in a relatively narrow, sideways trading range.

Despite the fact that the major averages have been spinning their wheels, there have been & always will continue to be, opportunities for swing trading both long & short. On the long-side, my focus remains on select commodities, typically agricultural commodities. On balance, the commodities trades in recent months have been profitable although at least one , SGG, exceeded the suggested stop yesterday for a modest loss. That trade, as well as any other official trades that have exceeded their suggested stop levels, will be updated by the weekend.

Back in the beginning of April, I starting highlighting what I referred to a “potentially explosive” trade setups in numerous solar stocks, the vast majority of which have experienced gains measured well into the double-digits so far & several of the setups posted back then & since are currently poised to breakout above bullish chart formations or key resistance levels. Many of those trade setups as well as additional solar stocks poised to rally can be found under the Long Swing Trade Setups category with additional setups shared within the Trading Room. Due to the sheer number of attractive setups recently posted in the solar stocks, most were shared as unofficial trade ideas, as posting updates on over a dozen stocks in the same sector, with specific price targets, suggested stops, suggested beta-adjustments, etc.. would be too time consuming.

While the solar stocks have been on fire, oil stocks have plummeted along with crude prices recently although XLE has now hit the 64 downside target that was highlighted in recent weeks. As such, the risk/reward is rapidly shifting to favorable for the energy sector. However, I plan to analysis the charts of both crude oil & the energy stocks a bit more before aggressively engaging the sector as I’d rather step in a bit late than a bit too early when trying to catch this falling knife. I would also like to avoid getting caught in a possible sideways trading range/basing pattern, which the energy sector would likely encounter, should the broad markets move lower in the coming weeks to months.

GLD (gold ETF) & GDX (gold miners ETF) were both recently highlighted on Tuesday as objective long entries as both had fallen to support level with the chart looking constructive. GLD & GDX bottomed around the time that video was published with both rallying since & both still looking poised for additional gains in the coming weeks+ although they are getting a bit stretched on the short-term time frames & might need to consolidate or pull back soon.

After spectacular gains heading into the U.S. elections back in November, the majority of cannabis stocks followed my prediction of a “buy the rumor, sell the news” cycle, rallying hard right up to the elections & experiencing a healthy* bout of profit taking since. (*healthy as many of those stocks became excessively overbought/over-valued). In recent weeks, however, I’m starting to see more & more of these stocks either breaking out, bouncing off support or setting up in bullish technical patterns. I plan to post some of the more promising setups soon.

I’m also monitoring XLF (financial sector ETF) as well as XBI & IBB (biotech ETFs) for a possible failure of their recent breakouts, which I favor along with my expectation for additional downside in the market leading FAAMG stocks & QQQ since their breakdowns on Friday June 9th. Should either or both of those sectors solidly move back below their respective breakout levels, that would likely have bearish implications on the broad market as fewer things in trading are more bearish than a failed breakout & both the financials & healthcare sector are key sectors in the S&P 500.

Miscellaneous

On an administrative note, I will be on a ‘semi-working’ vacation for the next two weeks although I will continue to monitor the markets as well as any trade ideas on the site & any new trading opportunity that develop. With that being said, market commentary & trade updates will be light over the next couple of weeks unless the markets or any particular sectors experience any very significant developments that may present some lucrative trading opportunities. Chart opinions & questions posted in the trading room will be answered at my earliest convenience & I would recommend using the contact form if you have any time sensitive questions or issues.