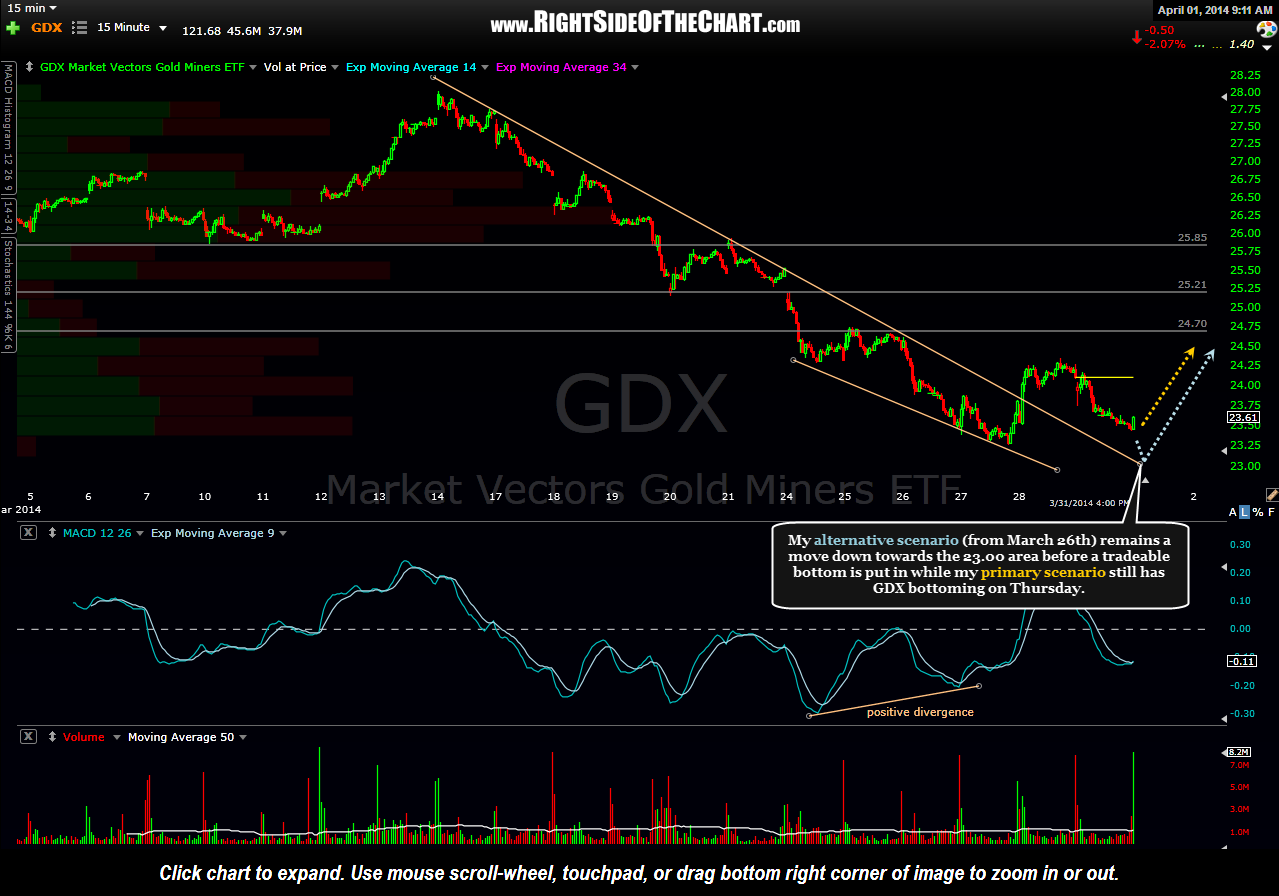

I took the day off yesterday and will be out of the office most of today but just wanted to post an update on GDX (Gold Miners ETF). As per the update posted on Wednesday of last week, my alternative scenario still has GDX making one final thrust lower to kiss the 23.00 horizontal support level + 61.8% Fibonacci retracement level. My primary scenario still has GDX bottoming on Thursday and moving higher from there.

So far, yesterday’s move lower in the mining stocks closed to print a higher low in the sector so there’s a good chance that today will either see prices drop below last week’s low of 23.27 (and likely bring prices down to the 23.00 area) or the GDX starts moving higher in an attempt to take out Friday’s reaction high of 24.35, which would be bullish and likely propel prices towards the first near-term target of 24.70. I still give only slight odds to my primary scenario & as such, continue to scale into the mining stock as this point vs. a full position. Updated 15 minute & 60 minute charts below.