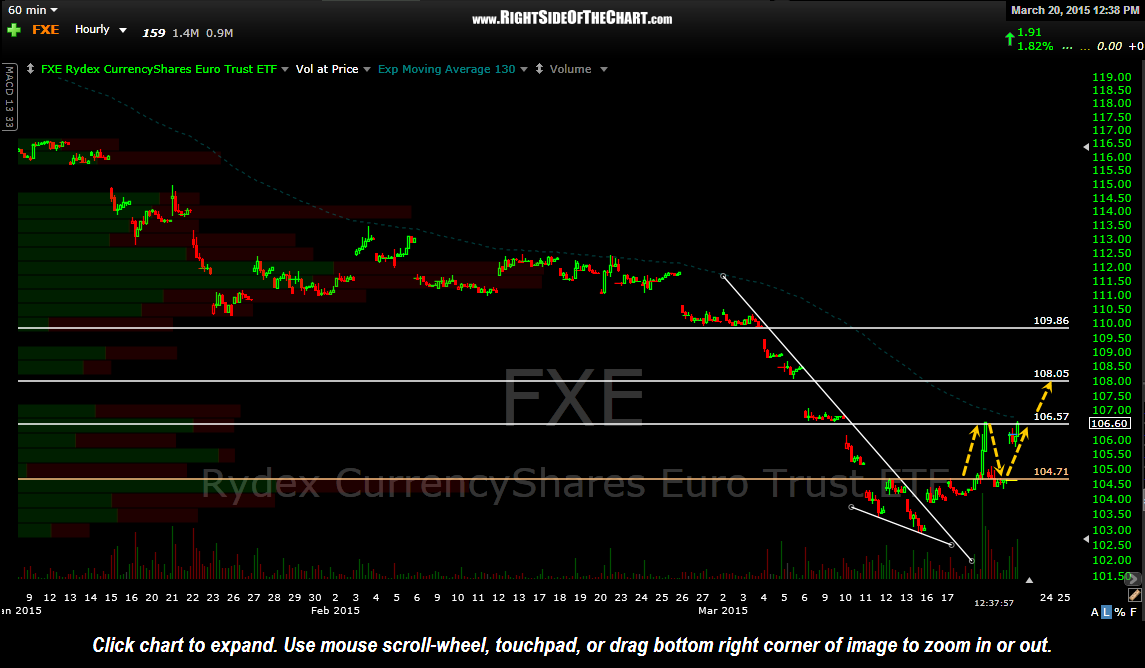

$FXE (Euro ETF) continues to trade off these previously posted support & resistance levels (buy & sell level) very well as yesterday’s pullback to the former resistance, now support level once again proved to be another timely entry for a quick trade back up to the 106.57 level. Although we are back at the 106.60ish resistance, my expectation is for a short-lived, if any, reaction before a continued move up to the next target around 108.

As discussed a few days ago, the fact that I was expecting a reversal in the dollar implied that the possibility existed for the bearish pennant pattern on the 60-minute chart of $GDX to break in the opposite direction than the masses were expecting. Following the reversal in the $USD, $GDX did in fact break to the upside of the pattern and as is so often the case when a bullish or bearish pattern breaks out in a direction opposite than that which was expected, the ensuing move has been quite impulsive so far, undoubtedly due in large part to short-covering in the gold stocks as well as new money coming in due to the recent drop in the $USD.

Finally, $QQQ is quickly approaching the “sweet spot” of the bearish rising wedge pattern were the final highs are made before a downside break & swift move lower. T1 remains my preferred swing target at this time & my expectation remains for that target to be hit on or before April 23th. Stops remain on a move above 111.

In summary, I remain near-term bullish on the $EURO, $YEN, $GLD, $GDX & other dollar sensitive assets including crude oil while bearish on the $USD and US Equities. Also note that the Rare Earth stocks are likely to catch a bid as well, assuming the the dollar down/gold up scenario continues to play out in the coming days & weeks.