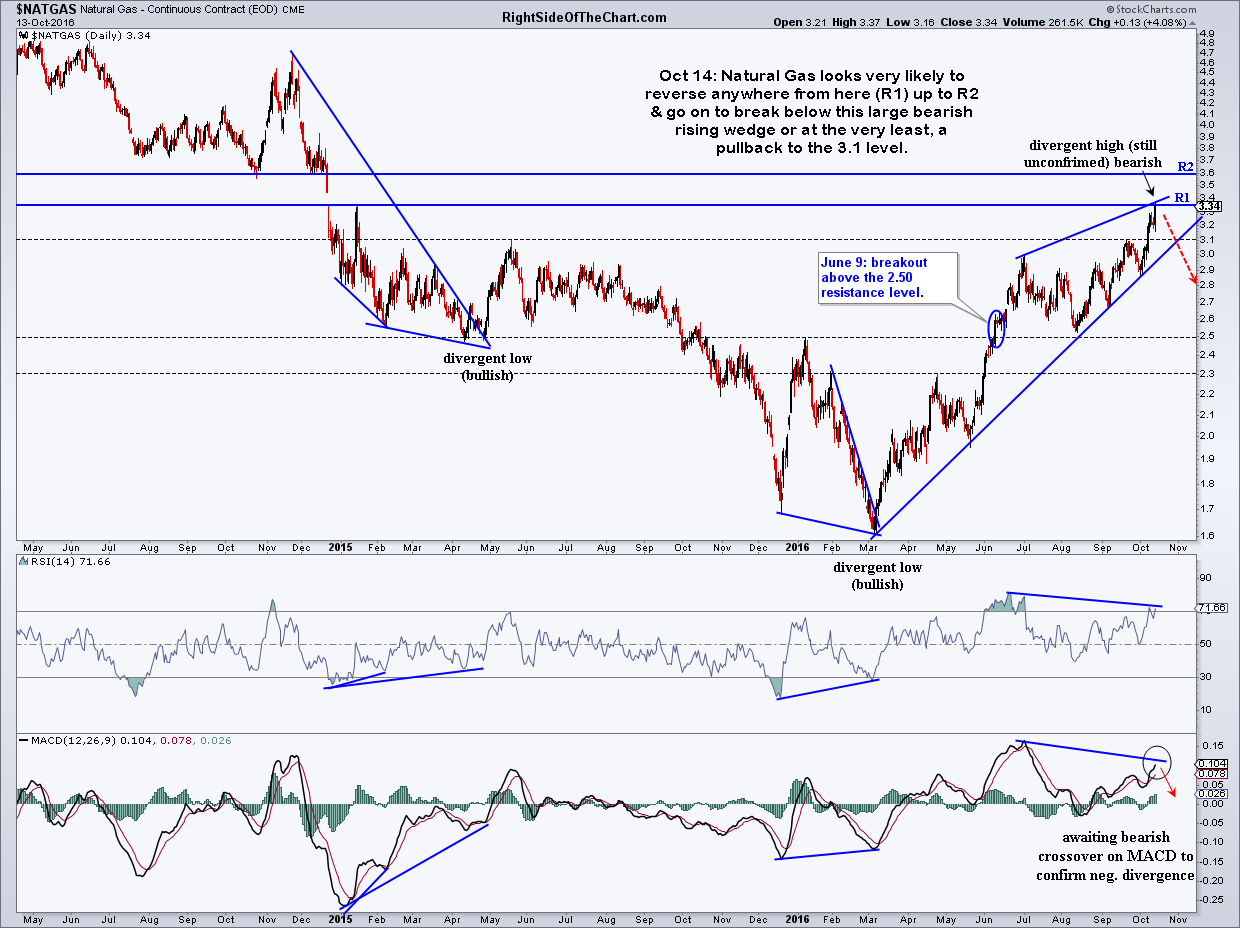

This update is simply highlighting a few things that stand out right now, most of which have been highlighted in the trading room. First up is natural gas. Several members in trading room are currently trading natural gas, including @joefriday, who has been actively posting charts & updates (thanks JF). That had brought it to my attention and as of this morning, I have taken a starter position in a nat gas short & may add it as an official trade idea soon. Natural Gas (spot prices on the chart below) looks very likely to reverse anywhere from here (R1) up to R2 & go on to break below this large bearish rising wedge or at the very least, a pullback to the 3.1 level. One can trade natural gas via futures or various leverage leveraged ETPs & if I decide to post this as an official trade idea, I will provide a list of some of those various trading proxies.

In the trading room, I was asked about a possibly entry on a BIS (2x short Nasdaq Biotech ETF), in which my reply was that I use the 1x ETFs for charting when trading the leveraged ETFs like BIS. IBB is the 1x for BIS (2x Nasdaq Biotech etf). Right now I have it at dual interesting support levels so I wouldn’t short it here, rather wait for a break below those levels or see how the charts shape up on a bounce. Here’s the daily chart of IBB. I’m also watching the other biotech ETFs, namely XBI & PBE as well as working on reviewing the top components of the biotech sector in order to determine if/when the sector might offer the next objective entry, long or short.