There are a few thoughts that I wanted to add to last night’s post in which the case was made that Australian stocks are likely to experience a bear market in the coming months. The most important point that I want to impress is that just because the $AORD looks “poised” for a bear market does not mean that a bear market in 2015 is certain. To use an example that most here in the U.S. are likely familiar with, just because the undefeated Kentucky Wildcats are “poised” to win the NCAA men’s college basketball championship does not guarantee that they will. Pasted below are my comments in responses to a couple of questions regarding last night’s post:

(reply): You’re most welcomed. In the future, I would like to provide more frequent coverage on the Australian markets. Shortly after I posted that chart of the $AORD, I thought about adding these comments, which I still might:

1) “Poised” for a correction does not necessarily mean that a correction is imminent. The odds favor it based on the charts but nothing in trading or technical analysis is 100%. On top of that, weekly divergences can persist for quite some time, even if they do ultimately manifest in the form of a correction or bear market.

2) If those divergences are to play out for a significant correction or bear market soon, we still need a decent sell signal on the daily or weekly time frame in order to confirm a short entry or heavily reducing exposure and/or exiting a long portfolio of Australian equities.

3) I received this question by email tonight that I figured is also worth sharing. The question & my reply below:

Q: can we conclude that natural resources (i.e. gold and silver) will also continue in bear mkt mode?

thank you.

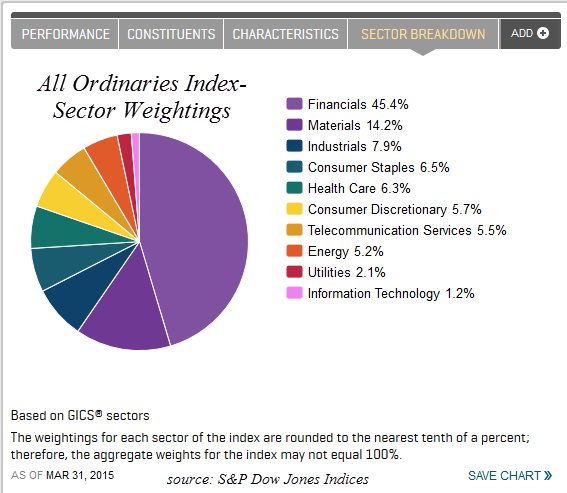

A: Funny you should ask. I was going to mention that because most people immediate associate the Australian stock market ($AORD) as being heavily commodity dependent. However, almost half of the $AORD is made up of financial stocks with a surprisingly low weighting of only 14.2% in the materials sector (and that’s all materials & metals, not just precious metals).

A: Funny you should ask. I was going to mention that because most people immediate associate the Australian stock market ($AORD) as being heavily commodity dependent. However, almost half of the $AORD is made up of financial stocks with a surprisingly low weighting of only 14.2% in the materials sector (and that’s all materials & metals, not just precious metals).

Q: (regarding point #2 above) What form would such a sell signal take?

A: Naturally, a break below the current bull market uptrend line would likely be a “relatively” early sign that the bull market has ended and a new bear market is underway but as I always say, one buy or sell indicator by itself is not a reason to get 100% long or short. If & when that bull market uptrend line gives way, I would be looking for supporting evidence that more downside is likely.

Of course, that uptrend line is quite a way below current prices, which are right off the top of the wedge or price channel. Therefore, I would be on the lookout for some near-term sell signals that would likely send prices back down to the uptrend line (which would be a decent & profitable correction to trade just to get there from here). As far as signals, any type of fairly reliable candlestick topping/reversal pattern. This site is a great resource for candlestick and chart patterns: http://thepatternsite.com/CandleVisual.html

I’m also watching the $AORD possibly starting to roll down after a second high-level backtest of a rising wedge pattern on the daily chart. As such, a somewhat aggressive short-entry could be made here with a stop not far above the recent highs and a swing target being that weekly bull market uptrend line.