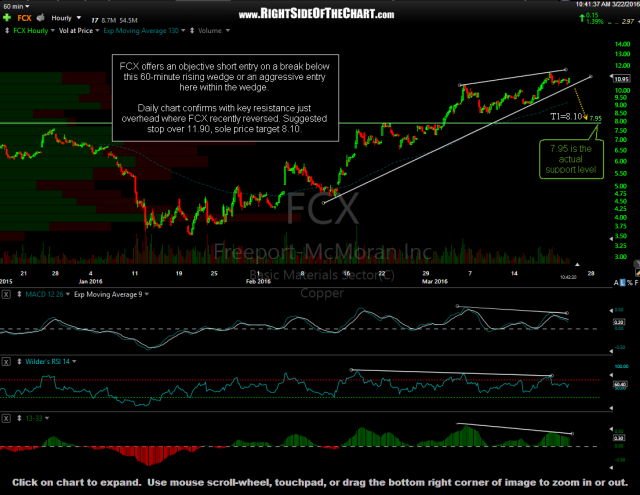

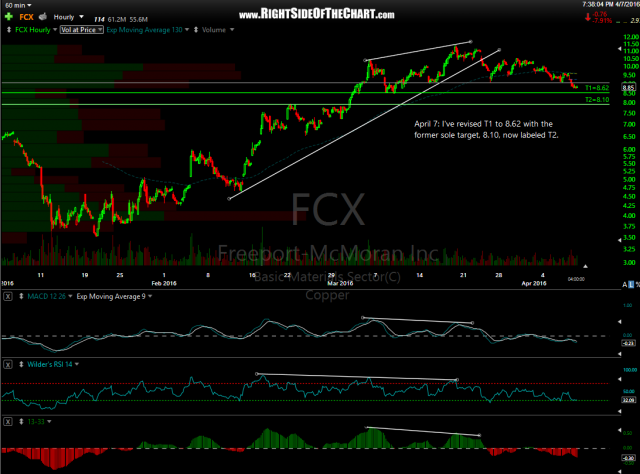

Upon further review of the charts, I’ve decided to add one additional price target to the FCX (Freeport McMoran Inc) active swing trade idea. FCX was added as an Active Short Swing Trade on March 22nd at a price of 10.95. The stock was shorted while still inside the wedge pattern as a breakdown appeared highly likely & imminent, which the stock going on to gap down the following day & close below the wedge. At that time, the sole price target of 8.10 was listed for the trade but a new first price target will be added at 8.61 with the former target now labeled at T2 and still the final price target. Previous & update 60-minute charts:

- FCX 60-minute chart March 22nd

- FCX 60-minute April 7th

With the stock closing down at 19.2% from the entry price today, it would only be prudent to lower stops at this point to protect profits. The official stop for this trade will be lowered from 11.90 to any move above 10.30 (of course, use a lower stop if that is your preference). Also note that depending on how the charts of industrial & precious metal stocks look if/when Freeport approaches the new T1, I may decide to officially close the trade out with T1 (8.62) as the final target