FAS (3x long financials etf) will be added as an official short trade here on this XLF bounce following the recent breakdown & backtest of the primary uptrend line. As this will most likely be a multi-month swing trade, FAS is my preferred proxy for shorting the financials at this time due to the added benefit of price decay from the 3x leverage.

I had mentioned personally establishing a starter short position in FAS back on May 18th, which is still profitable by about 6% (as of yesterday’s close) and I am taking advantage of today’s bounce in order add to that position. The 23ish area on XLF is the current final target although that is likely to be extended. Suggested stops on a close above the recent highs in XLF.

When trading the leveraged ETFs, my preference is the use the actual underlying index and/or the 1x tracking ETF (XLF in this case) in determining entry & exit points as the decay due to the leverage causes tracking error and a distortion to the charts over time. Should one decide to short FAS or SKF (2x short finanicals etf), consider the appropriate downward adjustment to your position size in order to accommodate for the increased risk & return potential from the leverage. (e.g.- a $10k position in XLF should equate to a $5k position in SKF or a $3,333 position in FAS).

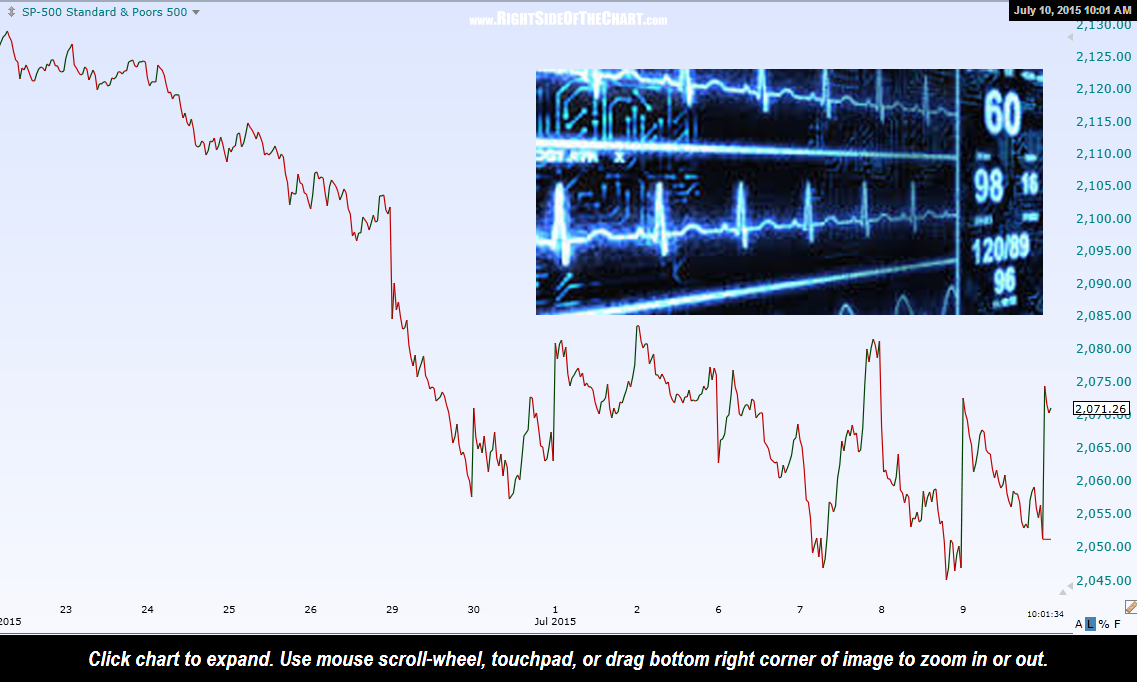

As predicted back in early June, this market has been plagued with extreme volatility lately, which typically serves to run out both disgruntled investors and frustrated traders, both long & short, who are tired of seeing their stops run only to have those positions snap back the next day. Choppy trading ranges like this don’t last forever so we are likely to see a relatively sharp, uni-directional breakout of this range one way or the other (up or down) soon. I still favor a downside resolution of this recent trading range but with the broad markets (and AAPL) at or very near key support levels, it would only be prudent to keep things relatively light until the markets either clearly breakdown or begin to mount a convincing rally off those levels.