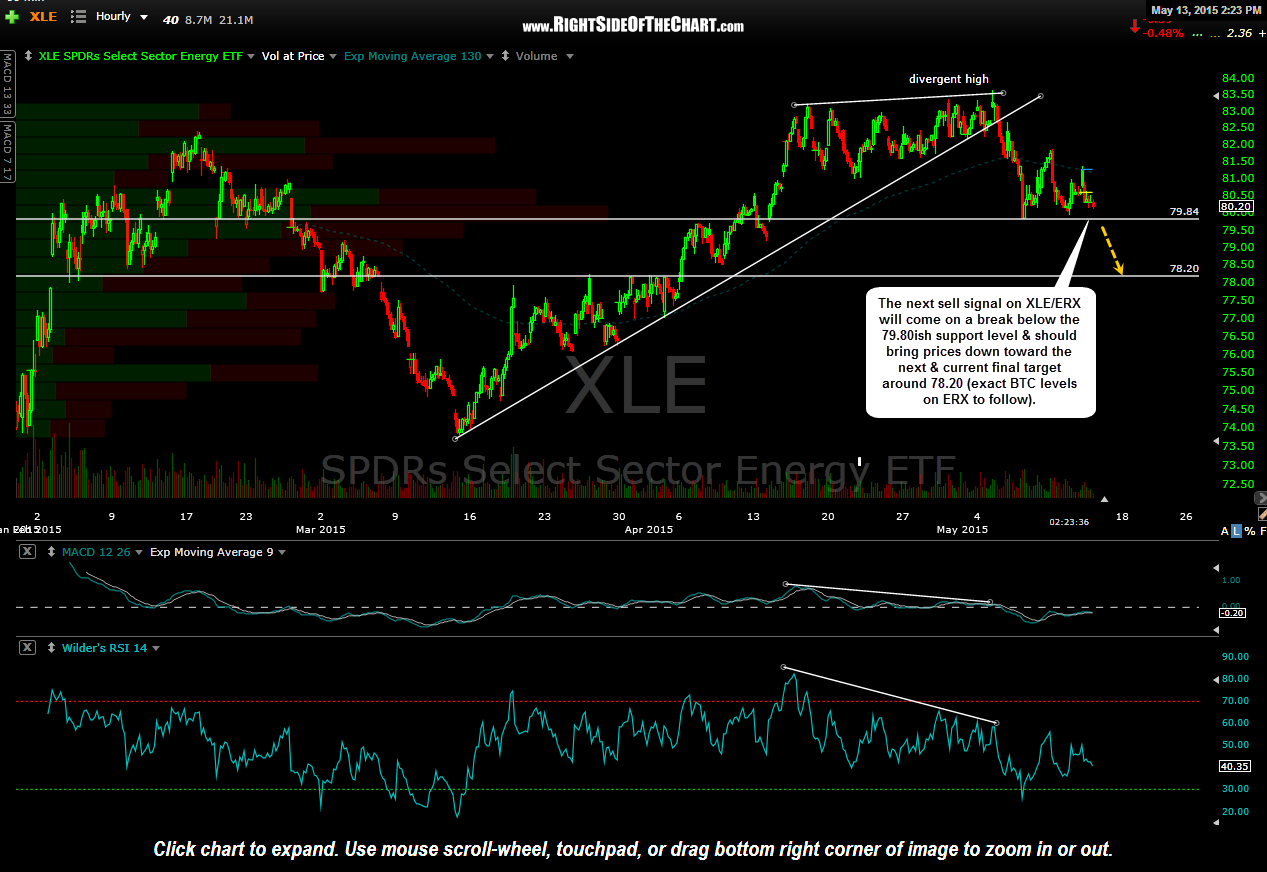

The next sell signal on XLE/ERX (3x & 1x long energy sector etfs) will come on a break below the 79.80ish support level & should bring prices down toward the next & current final target around 78.20 (exact suggested BTC levels on ERX to follow). The ERX short trade is current at a gain of about 10% and should XLE move down to the 78.20 area, which correlates to about the 57.00 area on ERX, that would add about another 5.5% profit to the trade, at which point I will most likely close it out & possibly reverse for a quick bounce long trade, should the charts confirm at the time.

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}