Nearly all major diversified U.S. stock indices closed solidly below the key intermediate-term uptrend lines which have guided the market higher since the August 24th meltdown. Whether or not today’s breakdowns prove to be a whipsaw signal, possibly induced from the fact today was a Quadruple Witching Day, is yet to seen. Today’s breakdowns follow on the heels of numerous false breakouts that occurred yesterday following the FOMC decision to hold rates steady.

- $NDX 60 minute Sept 18th

- QQQ 60 min 3 Sept 18th

- $SPX 60 minute Sept 18th

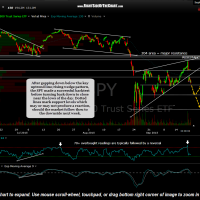

- SPY 60 minute 2 Sept 18th

- $RUT 60 minute Sept 18th

- $MID 60 minute Sept 18th

The 60-minute charts above have additional commentary along with potential support levels which could act as near-term downside targets. The overhead horizontal & downtrend lines are also likely to act as resistance, should today’s breakdowns prove to be another whipsaw signal, with the markets moving higher next week. Overall, the price action over the last two trading sessions has been unarguably bearish IMO and I continue to expect additional downside in the coming days/weeks & quite possibly months.