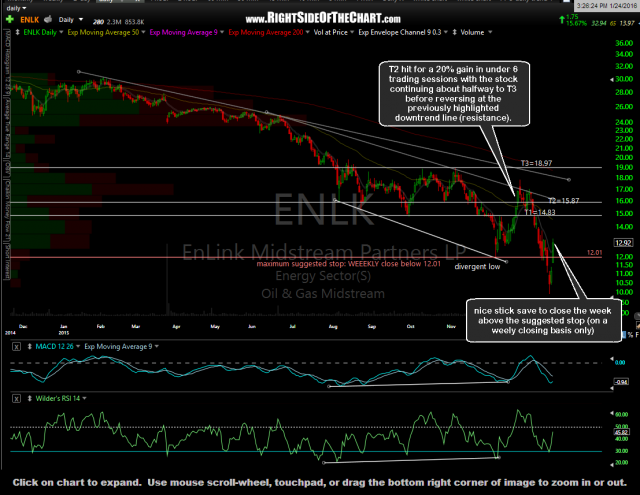

ENLK (EnLink Midstream Partners LP) was added as an Active Growth & Income Trade idea on December 15th, immediately moving sharply higher to hit the first target, T1 at 14.83, for a 12% gain 4 trading sessions later and going on to hit T2 (15.87) for a 20% gain the following day (Dec 23rd). From there, the stock continued to rise, without a single down day since entry, finally falling shy of the final target after two failed attempts to close above the first downtrend line (resistance) that was pointed out on the original chart.

- ENLK daily Jan 24th

- ENLK weekly Jan 24th

I had mentioned EnLink hitting these profit targets in both the trading room as well as one of the recent videos but hadn’t had a chance to post an official update recently. Also, I figured that this trade was worth highlighting now as it experienced some fairly bullish price action last week. The official maximum suggested stop (for those targeting T3, the final target) was and still remains any weekly close below 12.01. Last week, most likely in sympathy selling with the big plunge in crude prices, ENLK made a sharp break below the long-term support level highlighted on the previous weekly chart. However, on Thursday & Friday, the stock rose sharply on high volume (again, in unison with the strong rally in crude oil) to hammer back up (on the weekly time frame) right around that key long-term support level. Should the stock move higher from here, especially with one or two weekly closes above the 13ish level, we could be looking at a major bottom in the stock. With a forward annual dividend yield of nearly 15%, ENLK remains an attractive long-term, growth & income trade or investment candidate although it should be made clear that the stock remains in a precarious technical position, with some work to be done in order to help firm up the longer-term bullish case.