ELLI & CNDS are the last two official short trade ideas that have recently exceeded their suggested stop & as such, will be moved to the Completed Trades category. I wanted to include the charts along with some commentary on both as the help to illustrate a common recurring theme that I’ve noticed lately which seems to be one of stop clearing runs. Unlike many short trade setups that don’t pan out, with the technicals on the stock ultimately firming back up to confirm a bullish trend, what I’ve repeatedly seen in recent weeks are clearly bearish charts patterns, many of which have triggered very objective short entries with the stock breaking down below well-defined trendlines, charts patterns, support levels, etc.., followed by a snap-back rally that takes prices just beyond the level in which logical stop-loss order on a short trade or a new objective long entry would be placed.

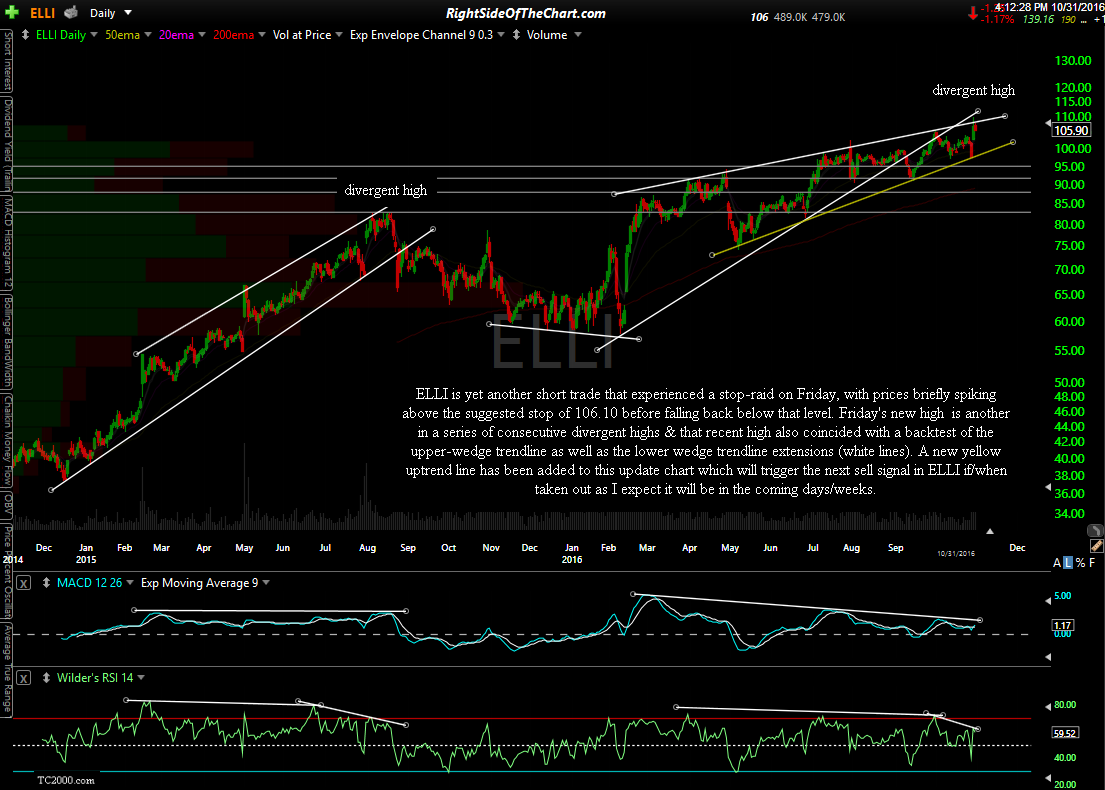

ELLI is one of the recent short trades that experienced what appears to be a stop-raid on Friday, with prices briefly spiking above the suggested stop of 106.10 before falling back below that level. Friday’s new high is another in a series of consecutive divergent highs & that recent high also coincided with a backtest of the upper-wedge trendline as well as the lower wedge trendline extensions (white lines). A new yellow uptrend line has been added to this update chart which will trigger the next sell signal in ELLI if/when taken out as I expect it will be in the coming days/weeks.

Essentially, the new yellow uptrend line & the previous upper-most white trendline which had defined the top of the previous wedge now form another bullish rising wedge pattern & the bearish nature of this wedge is also confirmed with negative divergence on the MACD & RSI. As such, ELLI may soon be added back as another short trade setup. For those still short ELLI, should Friday’s pop & drop prove to be a stop-raid, then ELLI should continue to move lower from here. As such, a stop on a closing basis above Friday’s high seems objective at this point.

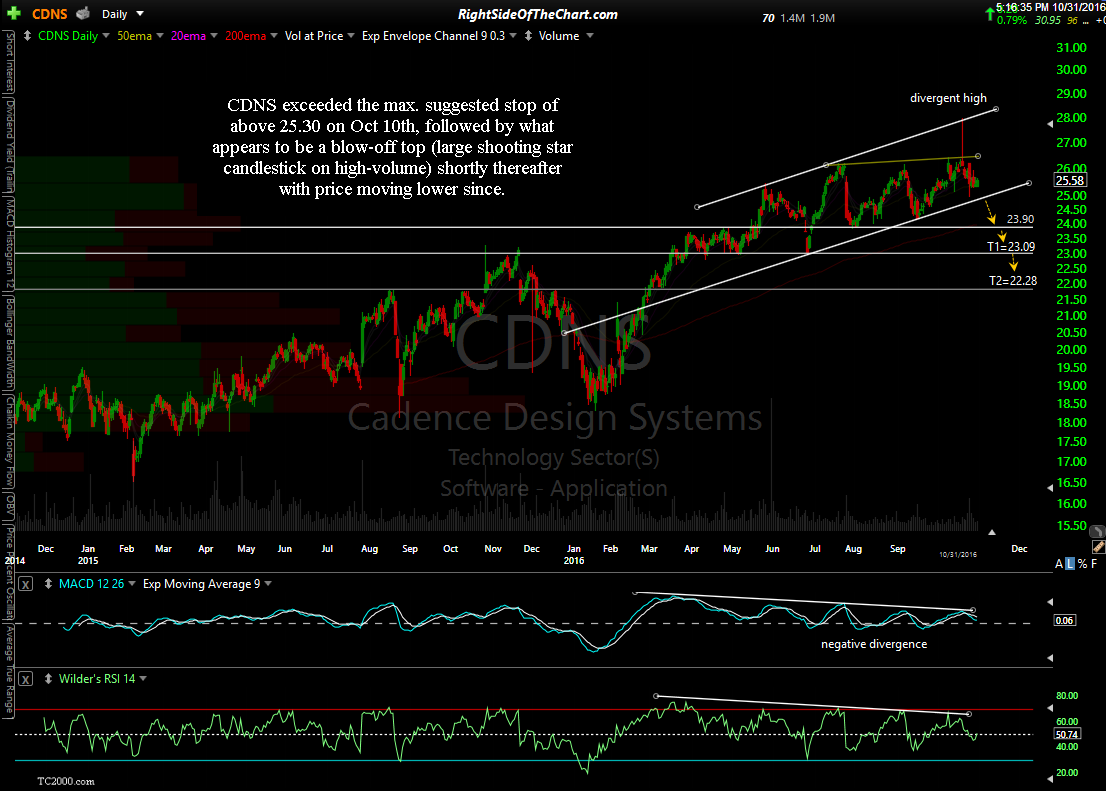

CDNS exceeded the max. suggested stop of above 25.30 on Oct 10th, followed by what appears to be a blow-off top (large shooting star candlestick on high-volume) shortly thereafter with price moving lower since. I have update the chart/trendlines on CDNS & added an additional target/support level at 23.90 which is likely to be hit following a break of the revised uptrend line.

As of now, all Short Trade ideas have been updated meaning those listed as Active Short Trades have yet to reach their final price target or maximum suggested stop & still look good at this time. I expect to have the Long Trade ideas update by the end of tomorrow at which point my focus will turn to adding any new trade setups that look compelling.