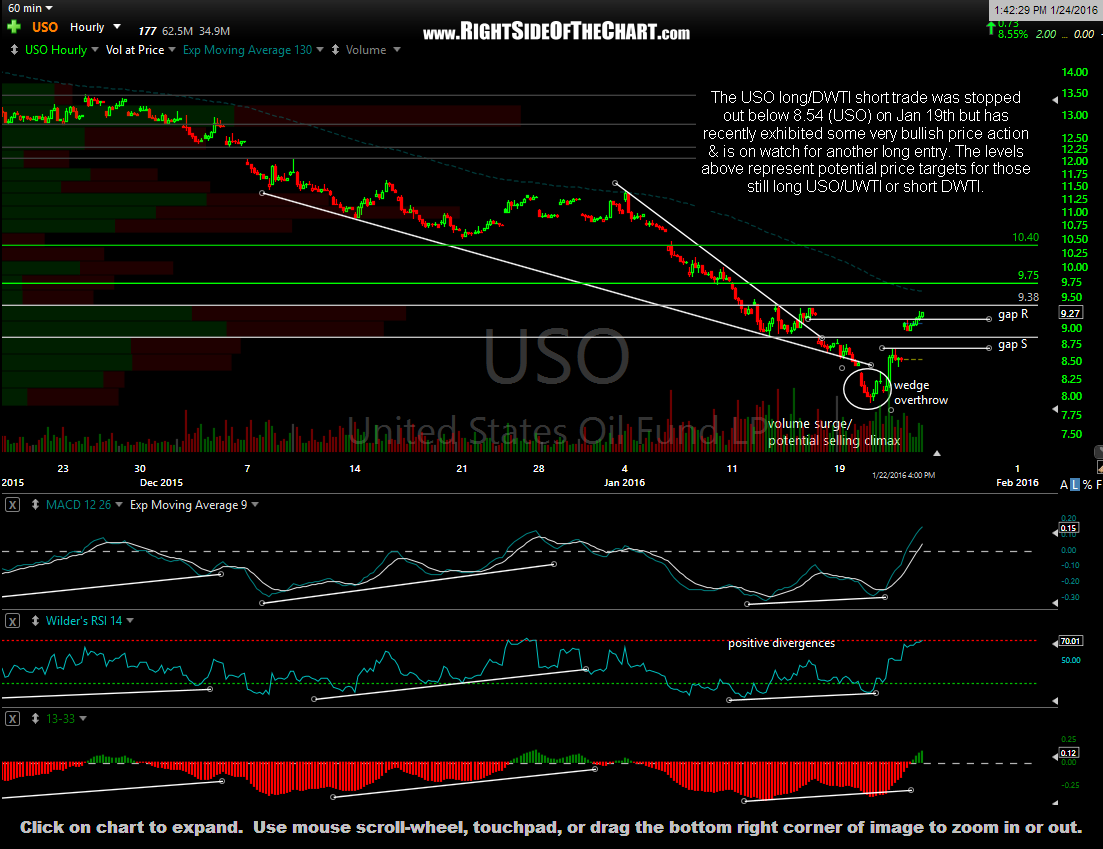

The previous USO long/DWTI short trade entered on Jan 14th exceeded the suggested stop of any move below 8.54 in USO shortly after the last update posted on Jan 19th. Accordingly, that trade has been moved to the Completed Trade category although crude oil is still on my radar as another official long trade idea following the very bullish price action into the end of the week. The levels in the 60-minute chart of USO below represent potential near-term price targets for those still long USO/UWTI or short DWTI, with longer-term targets to be added, should the charts continue to firm up from here.

In the last updated (which can be referenced in the hyperlink above), a large volume surge, which was indicative of a selling climax was highlighted. From there, USO continued to fall, making a downside overthrow below the bullish falling wedge pattern only to snap back sharply back above the pattern. Wedge overthrows are often very powerful whipsaw signals, in this case, bullish, as the overthrow occurred on a move below a bullish falling wedge pattern followed by a sharp reversal.

This could prove to be just one more in a long line of oversold/short-covering rallies in crude but the charts remain quite constructive with strong bullish divergences leading into the recent lows, coupled with what appears to be a selling climax. Once again, additional trade updates will follow today although email notifications will not be send out on all updates, particularly those which are not time sensitive.