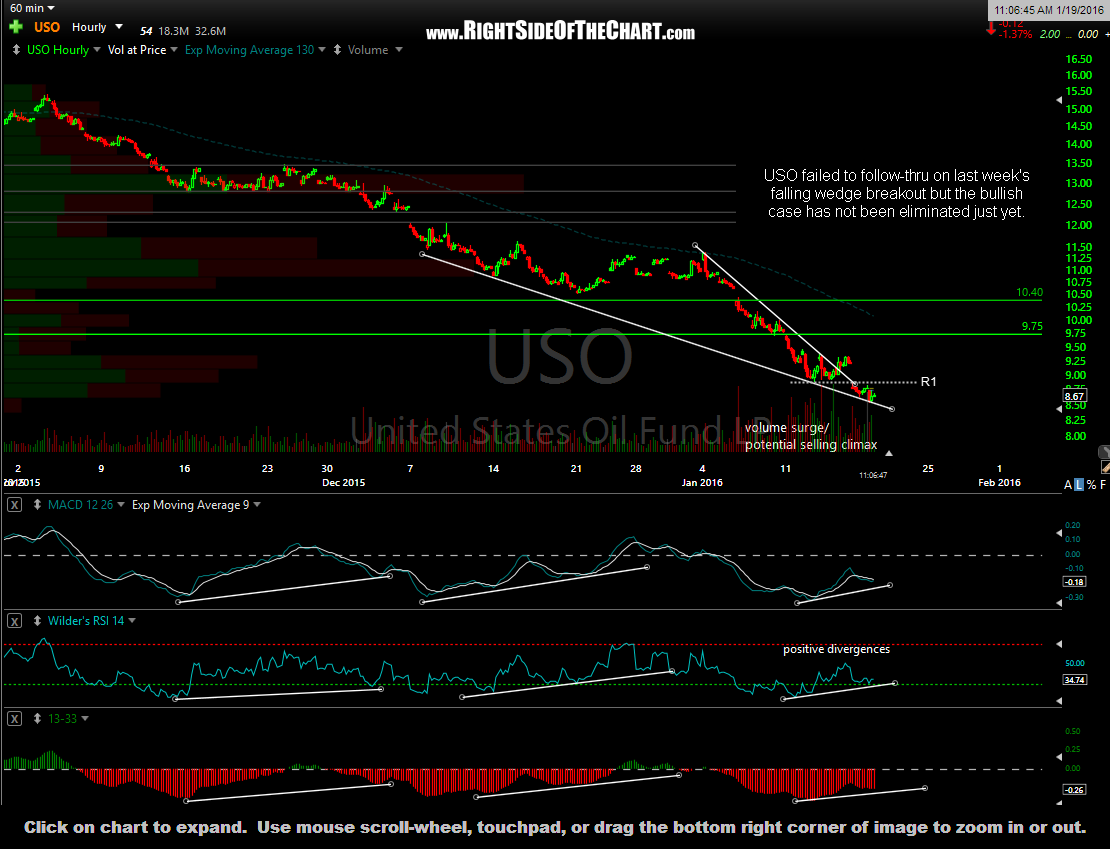

Here’s a look a various crude charts. Starting with the 60-minute chart of USO (crude ETP), USO failed to follow-thru on last week’s falling wedge breakout but the bullish case has not been eliminated just yet. We still have what appears to be a possible selling climax, evidenced by the recent surge in volume over the last couple of weeks in addition to positive divergences in place on the USO 60-minute chart.

The 60-minute chart of CL (crude futures) below also highlights the volume surge into the recent lows followed by volume expansion as prices recently started moving higher since Friday’s divergent low. The green arrows highlight the fact that CL has been in a short-term uptrend since those lows. A solid break above the 31.20ish level would likely spark a rally up towards the next resistance around 32.60.

Zooming out to a daily time frame on $WTIC (spot crude oil prices), we can see that crude oil still has positive (bullish) divergences in place on both the RSI as well as the MACD, which indicates the potential for a significant rally and/or trend reversal, should those divergences remain intact (which they should, unless crude prices move much below current levels). The horizontal lines on this chart are resistance level/potential price targets, with a major buy signal to come if/when prices can break out above this bullish falling wedge pattern.

As crude has just burned through one divergent low after another in recent months, also triggering several breakout above resistance that didn’t pan out for anything but a brief whipsaw signal, I won’t give the current USO long/DWTI short trade much more rope. Stops for either position will be set on any intraday move below today’s low of 8.54 on USO with the first two price targets set slightly below those green resistance levels on the USO 60-minute chart. T1 will be 9.68 and T2 at 10.34 with the possibility of additional price targets to be added, should the charts begin to firm up from here.