GDX (gold miners ETF) ran smack into major downtrend line resistance on the heels of a very extended run. My expectation is for at least one more thrust down back inside the wedge pattern before any lasting breakout.

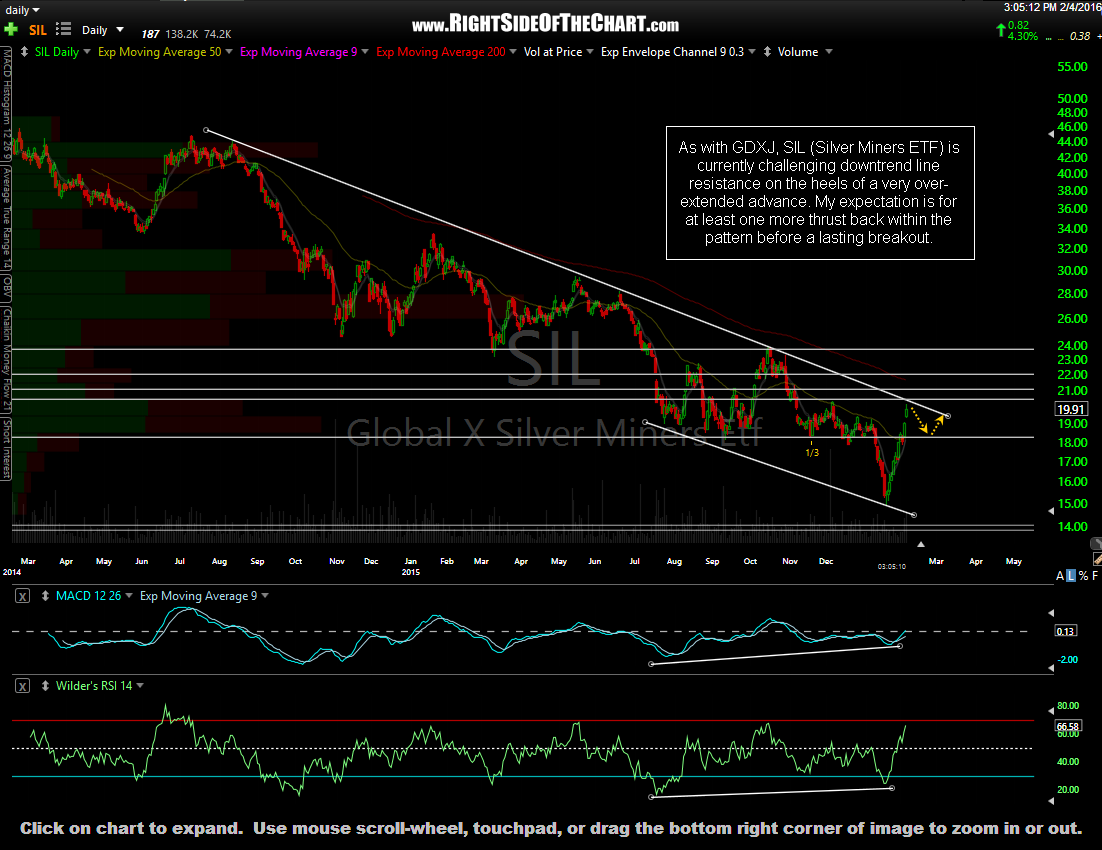

GDXJ (Junior Gold Miners ETF) is at downtrend line (and horizontal) resistance along with SIL (Silver Miners ETF). My Expectation is for at least one more thrust down inside the wedge or at best, a brief breakout, followed by a backtest of the wedge, before a move up towards the 24.50 target area. (note: yellow arrows are just a guesstimation of how these pullback scenarios might play out.)

I could easily see the miners holding up into the weekend, possibly even briefly taking out these downtrend lines but more often than not, on the initial tag of a key resistance level following a very extended run, the chances of a successful and lasting breakout are very low. Should the gold & silver miners break out in the coming days, my expectation would be for a backtest of these trendlines, which would naturally come in a levels below where these sector ETFs broke out. Just to reiterate, I the intermediate & longer-term charts on gold, silver & the miners look constructive. I’m just favoring a near-term pullback at this time.