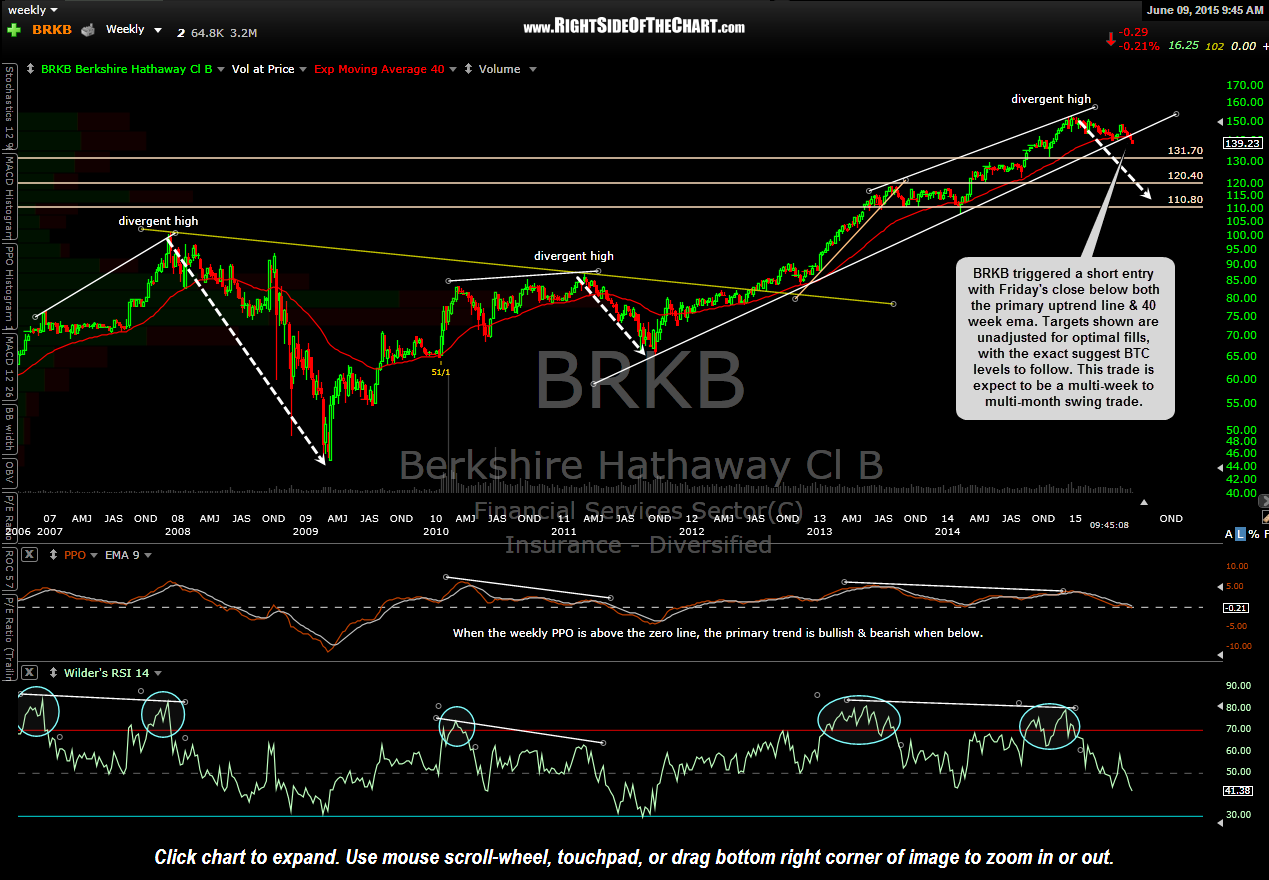

BRKB (Berkshire Hathaway Cl. B) triggered a short entry with Friday’s close below both the primary uptrend line & 40 week ema. Targets shown are unadjusted for optimal fills, with the exact suggest BTC levels to follow. This trade is expect to be a multi-week to multi-month swing trade.

On a related note, when the BRKB setups was posted here on May 18th, I mentioned shorting a starter position in FAS (3x long financials etf). XLF (1x financials etf) is now starting to crack below the minor uptrend line which is my next add-on trigger for my FAS short and with the last week’s BRK.B breakdown looking even more secure at this point, I will likely add XLF/FAS as an official trade idea shortly (under separate post). Berkshire is one of the largest components of the financial sector, which looks ripe for a substantial correction. More on XLF/FAS to follow.