As I’ve taken some time of from trading over the last few weeks, there are numerous trade ideas in need of updating. Some trades have hit one or more profit targets while others have exceeded their suggested stop levels or any reasonable stops, if none were suggested. As I update these trade ideas this week, email notifications will only be sent on time sensitive trades, such as those hitting a profit target or providing an objective entry or add-on at the time.

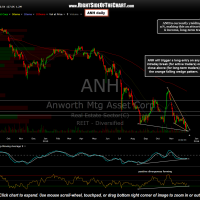

ANH (Anworth Mortgage Asset Corp) was added as both a typical swing trade setup as well as a Long-Term Trade/Growth & Income Trade Idea back on Dec 1oth and went onto to trigger an entry shortly thereafter on a breakout above the bullish falling wedge pattern. ANH hit all three profit targets, including the final target (T3) for a roughly 15% price gain plus dividends. This mREIT is now trading over 22% above the entry price while very overbought and trading at significant resistance as defined by the July & late Oct reaction highs in the stock. As such, the odds for a pullback are quite high at this time so consider booking full profits or at least raising stops, if still in this trade. As ANH has exceeded the previously posted final target, this trade will now be considered completed. Previous & updated daily charts below:

- ANH daily Dec 10th

- ANH daily March 3rd