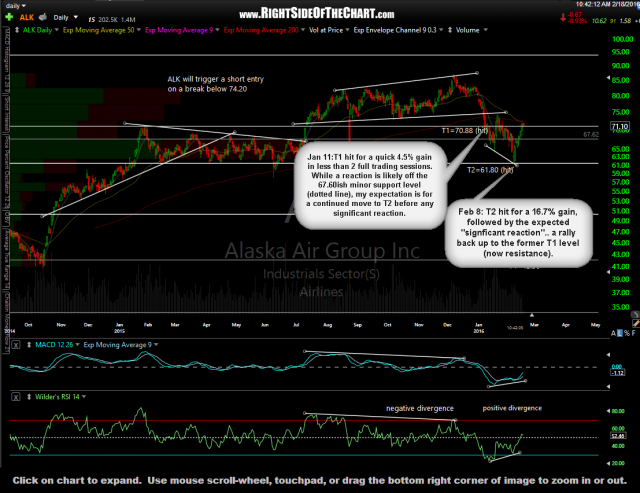

In updating the trade ideas today, I just noticed that I had not posted any updates on the ALK Active Short Trade since the first price target was hit on January 11th. At that time, I had stated that “T1 (had been) hit for a quick 4.5% gain in less than 2 full trading sessions. While a reaction is likely off the 67.60ish minor support level (dotted line), my expectation is for a continued move to T2 before any significant reaction.”

- ALK daily Jan 11th

- ALK daily Feb 18th

Fast forward to Feb 8th, less than one month later, and T2 (61.80), the second price target was hit, immediately followed by the expected “significant reaction”, an sharp rally that has now carried ALK back to the former T1 level, which is now resistance. ALK remains an Active Short Trade with the final target still T4 at 42.30 but this chart is a good example of why multiple price targets are used on most swing trade ideas on RSOTC as active traders can often micro-manage a trade around these levels by closing or reducing exposure when a bounce (or a pullback on longs) appears likely, then recycling back into the trade once that bounce has most likely run its course.