As mentioned in this morning’s market update, various agricultural commodities appear to have some of the most attractive R/R profiles right now, especially for long-side trades. The charts seem to indicate that many of these ag commodities appear to be setting up for attractive swing trades with rallies that could last several months & even into 2018. Adding commodities to one’s portfolio, whether a trading account or investment account, allows for diversification with little to no correlation with the stock market, fixed income, precious metals or other asset classes. Each of these commodity tracking ETNs (or one can use futures, if experienced & comfortable with them) are under consideration as official trade ideas but I wanted to share these charts along with my thoughts until then for those currently long or looking for alternative investing/trading ideas.

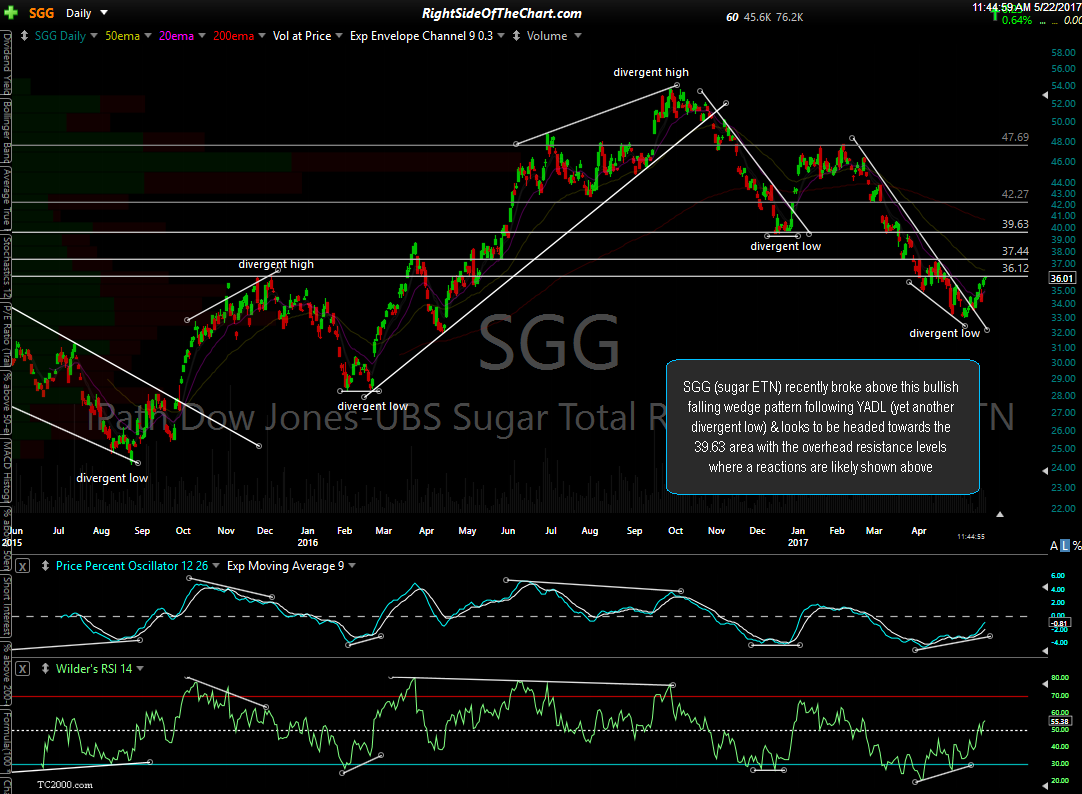

SGG (sugar ETN) recently broke above this bullish falling wedge pattern following YADL (yet another divergent low) & looks to be headed towards the 39.63 area with the overhead resistance levels where a reactions are likely shown on this daily chart.

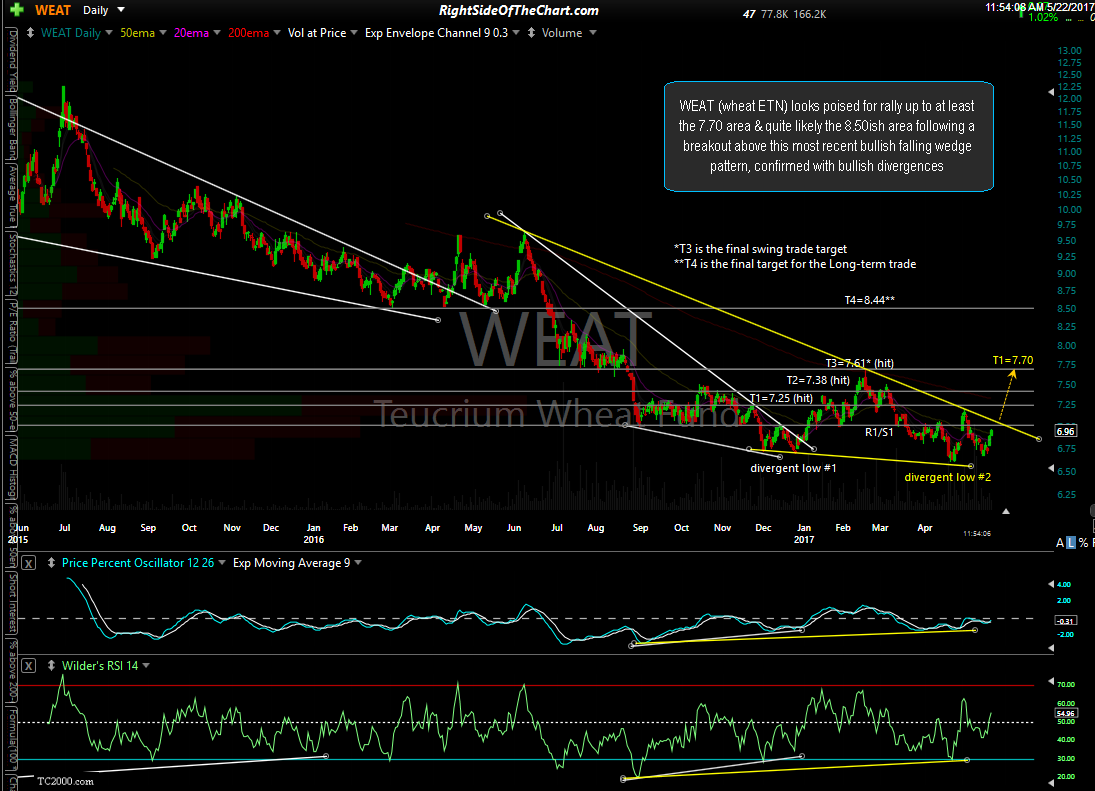

WEAT (wheat ETN) looks poised for rally up to at least the 7.70 area & quite likely the 8.50ish area following a breakout above this most recent bullish falling wedge pattern, confirmed with bullish divergences.

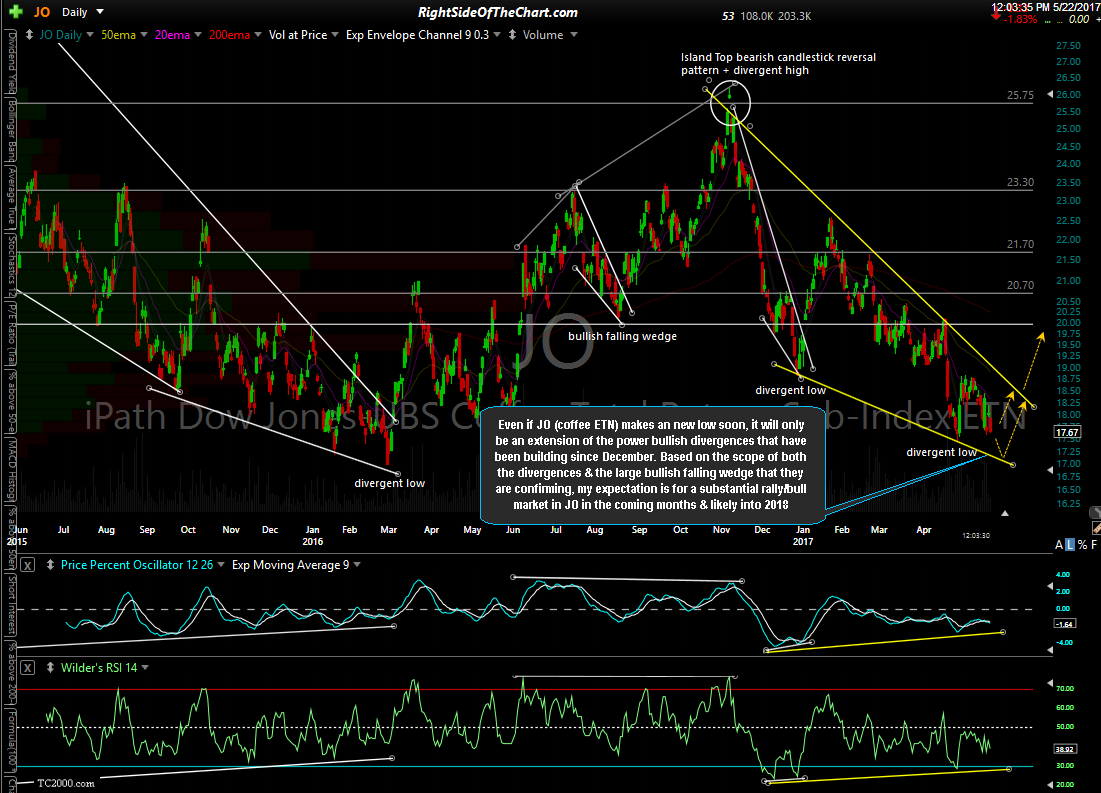

Even if JO (coffee ETN) makes an new low soon, it will only be an extension of the power bullish divergences that have been building since December. Based on the scope of both the divergences & the large bullish falling wedge that they are confirming, my expectation is for a substantial rally/bull market in JO in the coming months & likely into 2018.

CORN (corn ETN) looks poised to run to the 20.00 & quite level the 20.70ish level on a break above this downtrend line following the most recent divergent low.

While SOYB (soybean ETN) may have bottomed with last Thursday’s divergent low, I’m leaning towards a scenario with one last thrust down within this bullish falling wedge pattern before a meaningful trend reversal & rally in SOYB.

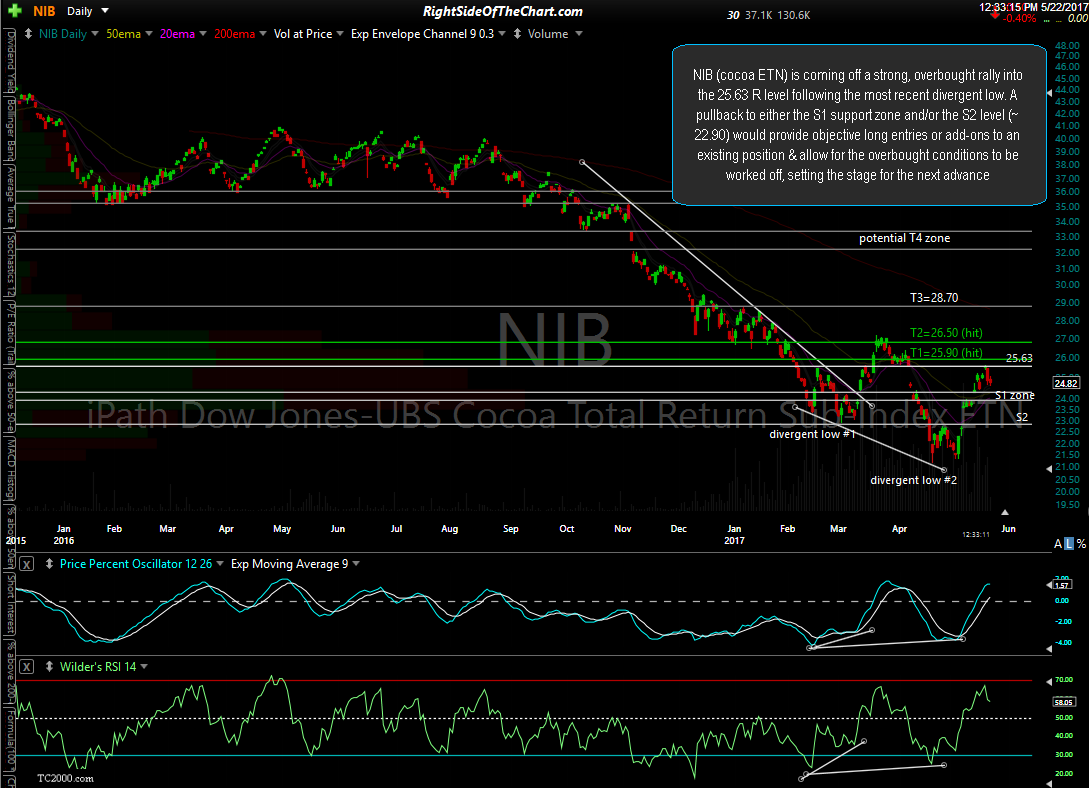

NIB (cocoa ETN) is coming off a strong, overbought rally into the 25.63 R level following the most recent divergent low. A pullback to either the S1 support zone and/or the S2 level (~22.90) would provide objective long entries or add-ons to an existing position & allow for the overbought conditions to be worked off, setting the stage for the next advance.