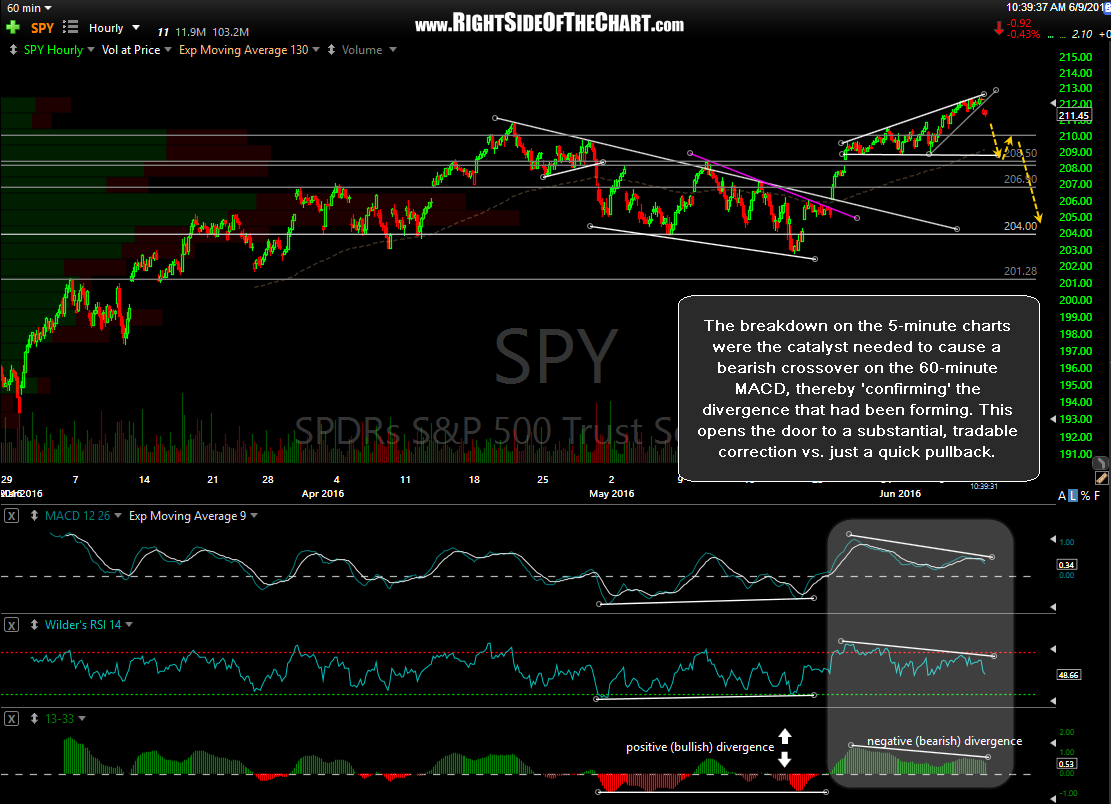

The breakdown on the 5-minute charts were the catalyst needed to cause a bearish crossover on the 60-minute MACD, thereby ‘confirming’ the negative divergence that had been forming. This opens the door to a substantial, tradable correction vs. just a quick pullback.

The SPY (or any of the broad market tracking ETFs) is not currently an official trade ideas although I do believe the broad markets, especially the small caps (IWM, TNA, etc..) still offer an objective short entry with a stop above the recent highs. A more aggressive stop on SPY could also be set on a move back above 212 (or 118.20 on IWM), for those preferring to use tight stops. The levels on this 60-minute SPY chart are just rough support levels although I will try to follow up with some firm downside targets for the major stock indices.